-

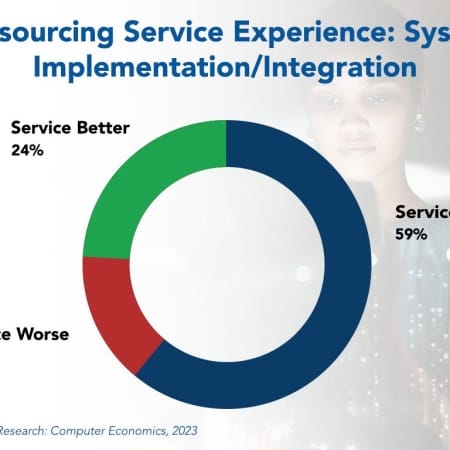

System Implementation/Integration Outsourcing Trends and Customer Experience 2023

System implementation/integration outsourcing is the use of an external service provider to assist in implementing new systems, which often includes integration with other new or existing systems. A systems integration (SI) firm can help or be responsible for some or all of the following: identifying system requirements, understanding and redesigning business processes, selecting a new system, and deploying the system.

November, 2023

-

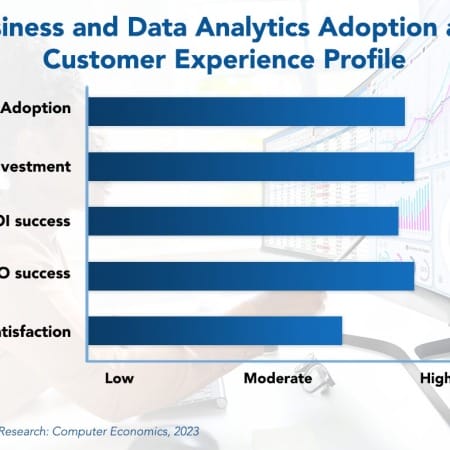

Business and Data Analytics Adoption Trends and Customer Experience 2024

Enterprises may be entering a new paradigm when it comes to business and data analytics. This may be characterized as the third phase of data usage inside the IT department. First came the use of retrospective data, where data was collected and used to analyze and understand previous performance. Second came predictive analytics, where past data was used to predict the future and make enterprise decisions. Most organizations are still mastering this phase.

December, 2023

-

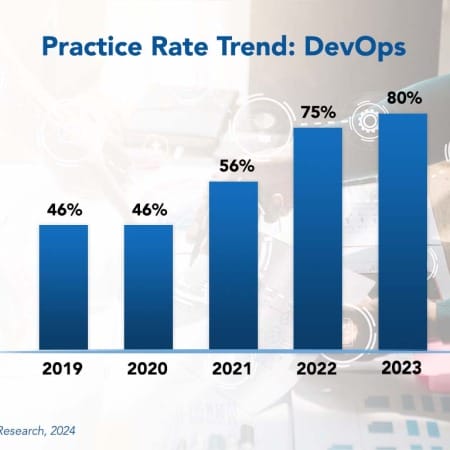

DevOps Best Practices 2024

Development operations (DevOps) is an organizational model that promotes collaboration between software developers and IT operations. The model allows for frequent deployment of systemic changes and includes a use for automation. DevOps is a natural extension of agile development into the deployment and operational phases of the systems life cycle. Just as agile development builds software in small, iterative build cycles, DevOps applies enhancements as small incremental changes committed daily, hourly, or even moment-by-moment into the production system.

February, 2024

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 9: Wholesale Distribution Sector Benchmarks

Chapter 9 provides benchmarks for wholesale distributors. The category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 31 respondents in the sample range in size from a minimum of about $50 million to $10 billion in revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 36: Government Agencies Subsector Benchmarks

Chapter 36 provides benchmarks for federal, state, and regional government agencies. The category includes public health agencies, courts and law enforcement agencies, organizations that provide IT services to government agencies, social service agencies, state parks, and other federal, state, and regional government units. The 21 respondents in the sample have operating budgets that range in size from about $62 million to about $40 billion.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 33: Professional Services Subsector Benchmarks

Chapter 33 provides benchmarks for professional services organizations. The 20 respondents in the sample range in size from a minimum of about $50 million to about $2 billion in annual revenue. The sector includes firms that provide professional services, including legal, accounting, financial advice, consulting, marketing, and other services.

July, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 12: Professional and Technical Services Sector Benchmarks

Chapter 12 provides benchmarks for professional and technical services organizations. The 45 respondents in the sample range in size from a minimum of about €50 million to about €80 billion in annual revenue. The sector includes firms that provide professional and technical services, including engineering, legal, accounting, financial advice, consulting, marketing, research, and other services.

September, 2023

-

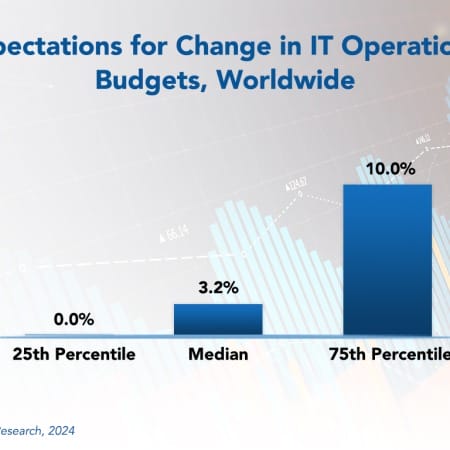

Worldwide IT Spending and Staffing Outlook for 2024

Our forecast for enterprise IT spending in 2024 is partly sunny, with a chance of strong headwinds. With stronger-than-expected economic data in the US and Europe and easing inflation, the world economy in most regions looks poised for the soft landing that central banks were aiming for. Our survey shows that IT budgets will continue to grow, and enterprises expect a slightly better 2024 than 2023. The worldwide outlook is cautiously optimistic.

March, 2024

-

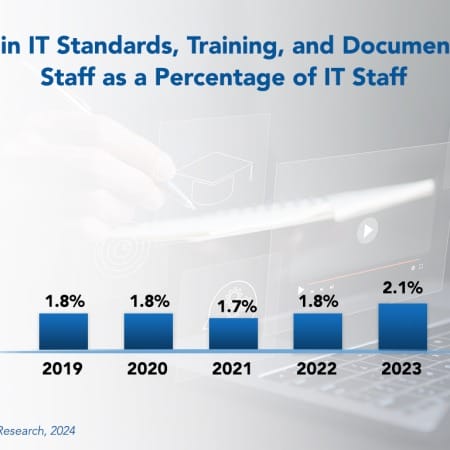

IT Standards, Training, and Documentation Staffing Ratios 2024

Some organizations tend to underestimate the importance of the IT standards, training, and documentation job function since its impact on the bottom line may not be clear. However, these job functions are essential for ensuring the smooth operation, compliance, and effectiveness of IT systems — all crucial elements for the overall success of any business.

April, 2024

-

Manufacturing Smart Industry Services 2023 RadarView™

The Manufacturing Smart Industry Services 2023 RadarView™ assists organizations in identifying strategic partners for engineering and manufacturing transformation by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key manufacturing smart industry service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right services partner. The 58-page report highlights top supply-side trends in the manufacturing smart industry space and Avasant’s viewpoint on them.

May, 2023

-

Digital Masters 2023 RadarView™

The Digital Masters 2023 RadarView™ assists organizations in identifying strategic partners for their digital transformation initiatives by offering detailed profiles for each service provider. It provides a 360-degree view of the provider’s capabilities and market standings in individual technology prerequisites, hyperconvergence of technologies, and readiness for the future, along with a list of representative clients and brief client case studies. The 60-page report also provides our business forecasts for each Digital Master and Avasant’s viewpoint on them.

August, 2023

-

SAP S/4HANA Services 2023–2024 RadarView™

The SAP S/4HANA Services 2023–2024 RadarView™ assists organizations in identifying strategic partners for adopting SAP S/4HANA by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key SAP S/4HANA service providers across practice maturity, partner ecosystem, and investments and innovation to help enterprises identify the appropriate service partner. The 77-page report also highlights the top supply-side trends in the SAP S/4HANA services space and Avasant’s viewpoint.

January, 2024

-

Claims Processing Business Process Transformation 2023 RadarView™

The Claims Processing Business Process Transformation 2023 RadarView™ helps organizations in identifying strategic partners for claims processing services by offering detailed capability and experience analyses of service providers in this space. It provides a 360-degree view of the service providers across practice maturity, domain ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right claims processing services partner. The 66-page report highlights top supply-side trends in the claims processing services space and Avasant’s viewpoint.

September, 2023

-

Clinical Services Business Process Transformation 2023 Market Insights™

The Clinical Services Business Process Transformation 2023 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any clinical services project. The report also highlights key challenges that enterprises face today.

May, 2023

Grid View

Grid View List View

List View