-

Digital Commerce Services 2022–2023 RadarView™

The Digital Commerce Services 2022–2023 RadarView™ provides information to assist enterprises in building an integrated digital commerce strategy and charting out an action plan for digital commerce transformation. It identifies key global service providers and system integrators that can help expedite a customer’s commerce transformation journey. It also brings out detailed capability and experience analyses of leading providers to assist businesses in identifying the right strategic partners. The 61-page report also highlights key industry trends in the digital commerce space and Avasant’s viewpoint on them.

February, 2023

-

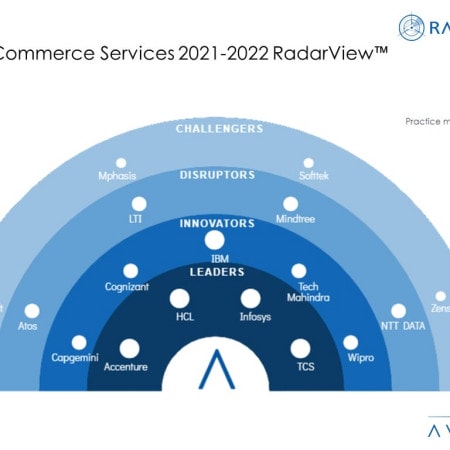

Digital Commerce Services 2021–2022 RadarView™

The Digital Commerce Services 2021–2022 RadarView™ provides information to assist enterprises in building an integrated digital commerce strategy and charting out an action plan for digital commerce transformation. It identifies key global service providers and system integrators that can help expedite a customer’s commerce transformation journey. It also brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 67-page report also highlights key industry trends in the digital commerce space and Avasant’s viewpoint on them.

January, 2022

-

Digital Commerce: Paving the Way for the Next Phase of Growth

Rapidly changing consumer behavior and supply chain disruptions have forced companies to pivot to new business and delivery models and to deploy new modes of customer engagement. Direct-to-consumer (D2C) commerce, omnichannel commerce, and adoption of digital channels for sales and payments have grown rapidly during and after pandemic shutdowns. This led to a growing demand for digital commerce services across industry verticals with service providers expanding their revenues by nearly 30% between 2020 and 2021. These emerging trends are covered in Avasant’s Digital Commerce Services 2021–2022 RadarView™.

-

Future of Retail: Accelerating Digital Transformation in Partnership with Wipro

The retail transformation has been accelerated by the COVID19 pandemic. The segments that did well in the pandemic (essential retail- e.g. grocery, e-commerce, home improvement etc.) are flush with resources to drive the next set of initiatives, while segments that struggled have to fight harder to get the attention of the customer. Retail customers continue to demand convenience, seamless experience and the right bargain, and the pandemic has instilled focus around health, safety and trust.

August, 2021

Grid View

Grid View List View

List View