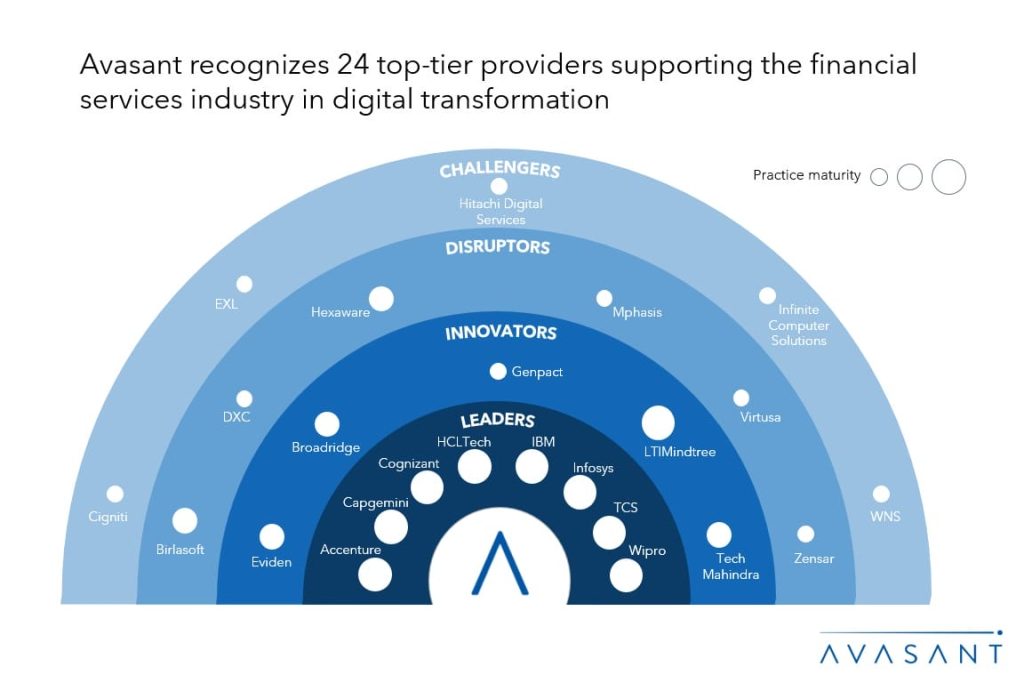

In today’s turbulent financial markets, the business landscape is rapidly evolving, driven by multiple factors, including the Great Wealth Transfer from older generations to younger, tech-savvy investors. This shift drives demand for smart advisory services facilitated by advanced analytics and personalized strategies. Additionally, there is a growing appetite for alternative investments and digital assets as investors diversify portfolios and new asset classes necessitate novel trade life cycles. Amid this evolution, the financial landscape is seeing a decline in M&As and initial public offerings (IPOs), focusing on reducing operational costs. Regulatory changes, such as the shift toward T+1 settlement cycles and the rise of ESG scores as an investment criterion, open new avenues as firms leverage digital technologies, including generative AI, to navigate these challenging times. Both demand-side and supply-side trends are covered in our Financial Services Digital Services 2024 Market Insights™ and Financial Services Digital Services 2024 RadarView™, respectively.