-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 42: Government Agencies

Chapter 42 provides benchmarks for federal, state, and regional government agencies. This category includes public health agencies, courts and law enforcement agencies, and organizations that provide IT services to government agencies, social service agencies, state parks, and other federal, state, and regional government units. The 15 respondents in the sample have operating budgets that range in size from about $62 million to about $40 billion.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 4: Process Manufacturing

Chapter 4 provides benchmarks for process manufacturers. Process manufacturers are defined as those where the production process adds value by mixing, separating, forming, or chemical reaction. This sector includes manufacturers of chemicals, petrochemicals, semiconductors, pharmaceuticals, dietary supplements, food and beverage products, cosmetics, building materials, packaging materials, steel, glass, paper products, and other process-manufactured goods. The 96 respondents in the sample range in size from a minimum of about $50 million to a maximum of around $70 billion in annual revenue

September, 2024

-

Marvell’s Silicon Surge Continues

SANTA CLARA, Calif.—Semiconductor maker Marvell Technology has experienced a significant surge this year, and it’s due in large part to its focus on making custom silicon for hyperscalers. Founded in 1995, Marvell started with an emphasis on consumer electronics. But it transformed itself into a global semiconductor company that designs, develops, and markets a wide range of integrated circuits. The company’s products are used in data centers, networking, storage, and consumer electronics. We attended Marvell’s Analyst Day this week to learn more about the surge this year and its plans for the future.

December, 2024

-

DBA Staffing Continues to March Onward

After years of remaining steady, there has been a notable increase in the proportion of database administrators (DBAs) within IT departments, particularly in small organizations. New data-driven initiatives, including generative AI, omnichannel communication, and real-time analytics, are inspiring enterprises to make their data lakes deeper and deeper, while data security concerns and regulatory requirements intensify. DBAs’ expertise in maintaining and safeguarding sensitive information is paramount. This Research Byte summarizes our full report on database administration staffing ratios.

February, 2025

-

Network Support Staffing Ratios 2025

Following a sharp decline in 2022, the demand for network support personnel has increased and they now make up a larger portion of the IT staff than they have since 2021. Network staffing has been highly volatile in recent years due to economic and technological factors, ranging from the COVID-19 pandemic to the growth of AI.

June, 2025

-

IT Spending and Staffing Benchmarks 2025/2026: Chapter 6: Banking and Finance

Chapter 6 provides benchmarks for banking and financial services companies. The firms in this sector include commercial banks, investment banks, credit unions, mortgage lenders, consumer finance lenders, and other types of lenders and financial services providers. The 37 respondents in this sector range in size from a minimum of about $50 million to over $150 billion in annual sales.

August, 2025

-

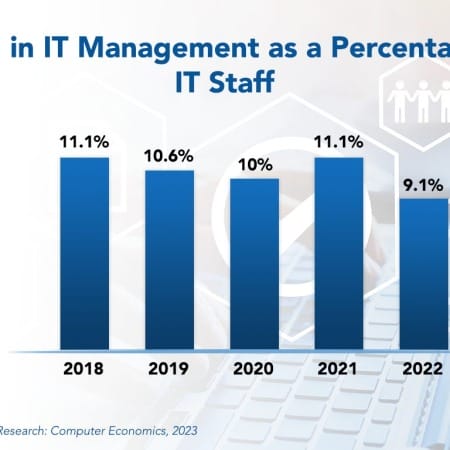

IT Management and Administration Staffing Ratios 2023

When it comes to IT managers, it is important to find the “sweet spot.” Too many managers and the IT group can become top-heavy and bureaucratic; too few and IT staff members may feel unsupported and without direction. Overworked managers may be pulled in too many directions, and insufficient management resources may push management tasks on to workers who are ill-equipped to take on those roles.

June, 2023

-

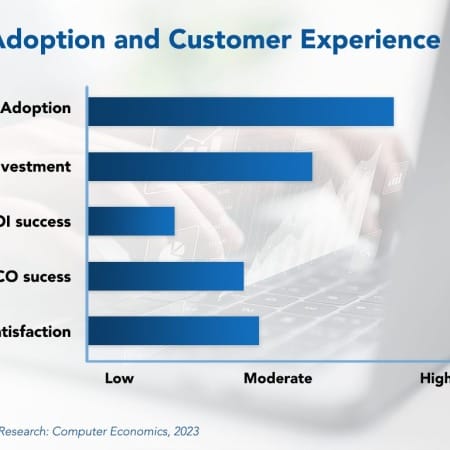

CRM Adoption Trends and Customer Experience 2023

Customer relationship management systems are one of the most widely adopted categories of enterprise applications, and investment in new CRM capabilities continues to grow. Although cloud-based CRM offerings have allowed the capabilities to move down-market to smaller companies, the need to adopt a CRM system signals that a company has reached a milestone in the building of its application portfolio, similar to when a company first moves from spreadsheets to a real accounting system. Modern CRM systems are essential for companies looking to improve their productivity and effectiveness in sales, marketing, and customer service.

October, 2023

-

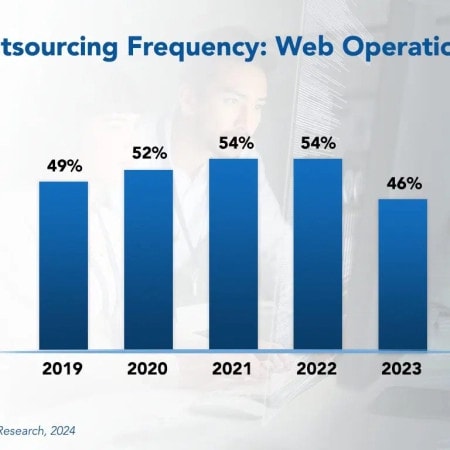

Web Operations Outsourcing Trends and Customer Experience 2024

Web operations outsourcing is one of the most popular types of managed services. Organizations of all kinds continue to expand their efforts in online marketing, website management, and e-commerce. This shift toward web-enabled business processes and e-commerce has prompted many companies to reassess their online strategies. In doing so, many have turned to managed service providers that can provide the needed expertise and a flexible, scalable infrastructure to deliver highly available and reliable web and e-commerce systems.

February, 2024

-

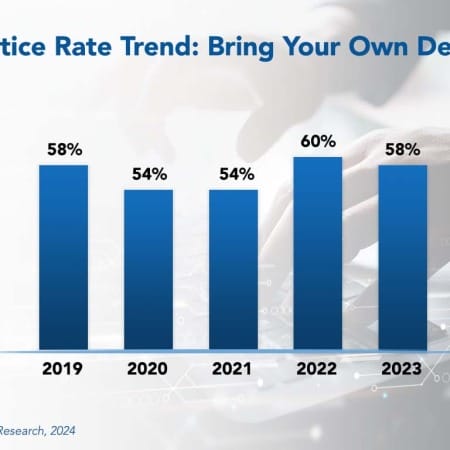

Bring Your Own Device Best Practices 2024

When iOS and Android smartphones were widely available in the late 2000s, bringing your own device for work-related tasks became popular. Employees generally favored their devices over those issued by the company, because it was simpler not to carry two devices. This trend drove companies to develop rules and regulations to control the practice.

March, 2024

-

Worldwide Technology Trends 2024

This study is designed to give business leaders insight into the adoption, investment, and customer experience for 15 technologies in each category. It provides a glimpse into how quickly an emerging technology is being adopted, how deeply more established technologies penetrate the market, and how positive the customer experience is with each of them. The study also delves into the specific types of solutions under consideration. By understanding the adoption trends, investment activity, and customer experience, decision-makers are in a better position to assess the potential risks and rewards of investing in each of these technologies. They also can gain insight into just how aggressively competitors and peers are investing in them.

May, 2024

-

IT Spending Trends in Transportation and Logistics 2024

This report analyzes the IT characteristics of the transportation and logistics sector, along with the competitive threats posed by digital disruption. Based on our latest benchmarking survey, it provides key metrics for the sector organizations. We conclude with the outlook for increased IT spending and staffing in the sector in the coming years.

August, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 15: IT Services and Solutions

Chapter 15 provides IT spending and staffing statistics for the IT services and solutions sector. This category includes software companies, SaaS providers, systems integrators, IT solution providers, business process outsourcing firms, and other providers of IT services and solutions. There are 49 organizations in the sample, ranging in size from around $50 million to over $100 billion in annual revenue.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 43: Logistics

Chapter 43 provides benchmarks for logistics providers. The 21 respondents in this sample range in size from $52 million to about $100 billion. This subsector is comprised of logistics companies that transport goods, including refined petroleum distributors, national moving or courier companies, freight transportation companies, supply chain logistics providers, and other logistics companies.

September, 2024

-

IT Spending and Staffing Benchmarks 2024/2025: Chapter 5: Discrete Manufacturing

Chapter 5 provides benchmarks for discrete manufacturing organizations. Discrete manufacturers are defined as those where the production process adds value by fabricating or assembling individual (discrete) unit production. This category includes manufacturers of consumer products, athletic equipment, industrial equipment, telecommunications equipment, aerospace products, furniture, auto parts, electrical parts, medical devices, and electronic devices, among other products. The 79 respondents in this sample range in size from a minimum of about $50 million to over $300 billion in annual revenue.

September, 2024

Grid View

Grid View List View

List View