-

Veeva Services 2025 Market Insights™

The Veeva Services 2025 Market Insights™ outlines key trends influencing how life sciences organizations adopt and use Veeva platforms. It also identifies common challenges companies face in implementing and scaling Veeva solutions across areas such as R&D, regulatory, quality, and commercial operations.

April, 2025

-

Orange Cyberdefense Reports Changing Trends in Cyber Extortion and Ransomware

Ransomware and cyber extortion are not only becoming more common but more damaging to enterprises. As cyberattacks become more sophisticated, often supported by nation-states, they are leading to high-profile and embarrassing releases of customer data. Orange Cyberdefense, which held an analyst event in Antwerp, Belgium, followed a few days later by a customer and partner event in London, England at the end of November 2022, is countering these threats by providing new managed security services offerings, including increased threat intelligence, and supporting secure access service edge (SASE).

March, 2023

-

Risk and Compliance Services 2023 RadarView™

The Risk and Compliance Services 2023 RadarView™ assists organizations in identifying strategic partners for risk and compliance services by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right technology partner. The 59-page report highlights top supply-side trends in the risk and compliance space and Avasant’s viewpoint on them.

October, 2023

-

Property and Casualty Insurance Management Software 2023 RadarView Scan™

Avasant’s Property and Casualty Insurance Management Software 2023 RadarView Scan™ helps enterprises in evaluating key vendors providing P&C insurance management software. The 29-page report also highlights how vendors leverage their capabilities to provide P&C insurance management services to address these challenges.

December, 2023

-

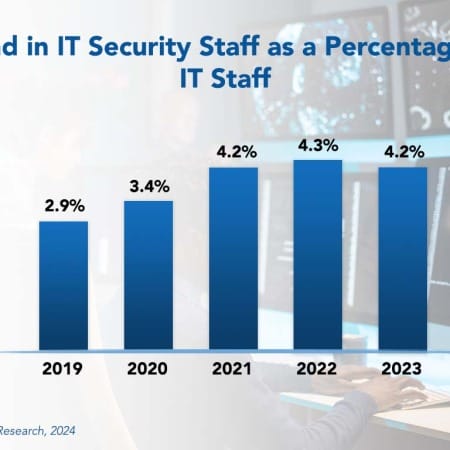

IT Security Staffing Ratios 2024

The constant beating drum of new security vectors and the recent impact of remote and hybrid work have placed pressure on IT security staffing levels. Enterprises have been steadily increasing IT security budgets and personnel for years. However, IT security personnel as a percentage of the total IT staff has decreased slightly from 4.3% in 2022 to 4.2% in 2023. For three years, security personnel as a percentage has been flat, ranging between 4.2% and 4.3%. Has the supply of IT security personnel finally reached its cap?

February, 2024

-

Cloud Platforms 2024 Market Insights™

The Cloud Platforms 2024 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any cloud adoption project. It also provides insights into the key use cases addressed by enterprises across various industries.

June, 2024

-

Avasant Digital Workplace Services 2024 RadarView™

The Digital Workplace Services 2024 RadarView™ assists organizations in identifying strategic partners for workplace transformation by featuring detailed capabilities and analyses of leading service providers. It provides a 360-degree view of key digital workplace services providers across practice maturity, partner ecosystem, and investments and innovation. The 76-page report highlights top supply-side trends in the digital workplace services space and Avasant’s viewpoint on them.

September, 2024

-

Generative AI Services 2024 Market Insights™

The Generative AI Services 2024 Market Insights assists organizations in identifying important demand-side trends that are expected to have a long-term impact on their Gen AI projects. The report also highlights the key challenges enterprises face today in this space.

October, 2024

-

End-user Computing Services 2024–2025 Market Insights™

The End-user Computing Services 2024–2025 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any end-user computing services project. The report also highlights key challenges that enterprises face today.

December, 2024

-

Airlines and Airports Digital Services 2025 Market Insights™

The Airlines and Airports Digital Services 2025 Market Insights™ assists organizations in identifying important demand-side trends that are expected to have a long-term impact on any digital project in the airline and airport industry. The report also highlights key challenges that enterprises face today.

April, 2025

-

Application Management Services 2025 RadarView™

The Application Management Services 2025 RadarView™ assists organizations in identifying strategic partners for application management services by offering detailed capability and experience analyses for service providers. It provides a 360-degree view of key application management service providers across practice maturity, partner ecosystem, and investments and innovation, thereby supporting enterprises in identifying the right application management services partner. The 72-page report highlights top supply-side trends in the application management services space and Avasant’s viewpoint on them.

June, 2025

Grid View

Grid View List View

List View