-

Beefed-Up HCM Systems Helping Companies Address HR Talent Gap

Business leaders recognize that success depends on recruiting and retaining the best people. But, this puts increasing pressure on HR personnel, who are already stretched with the day-to-day demands of routine HR processes and compliance activities. One solution is cloud-based and AI-enabled HCM systems to help improve the efficiency and effectiveness of HR personnel. This Research Byte summarizes the full report, HCM Adoption Trends and Customer Experience.

November, 2021

-

HCM Adoption Trends and Customer Experience 2021

Human capital management (HCM) systems are becoming increasingly essential as business leaders recognize that success depends on recruiting and retaining the best people. But while the adoption rate for HCM systems is high, there are challenges in deploying them. This report quantifies the current adoption and investment trends for HCM technology as well as the benefits driving companies to expand their HCM implementations. We assess these trends by organization size, sector, and geography as well as the ROI and TCO experiences of adopters. We conclude with practical advice for planning new investments in HCM systems.

November, 2021

-

Compliance Requirements Driving the Move to Government Clouds

The dramatic shift towards smart cities and a new digital economy is increasing the need for governments to upgrade their IT infrastructure. Cloud environments are the best way to ensure government systems are highly available and data is securely accessible. But until recently, cloud was not always an option for government entities due to strict compliance requirements. Now providers are catering to this need by setting up government clouds—sovereign data centers to employ local workers in the countries they intend to serve.

November, 2021

-

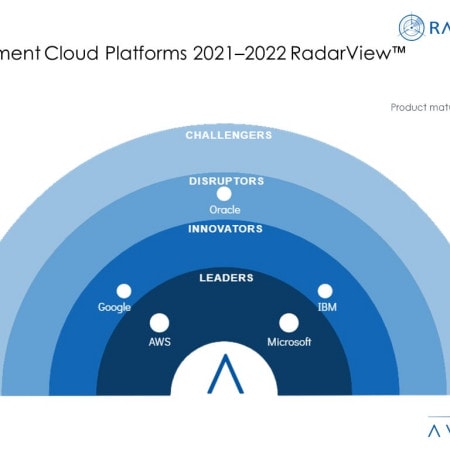

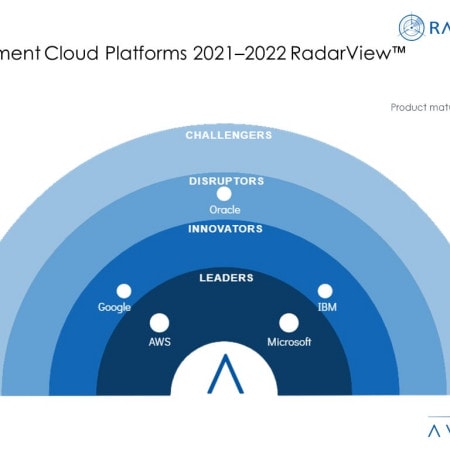

Government Cloud Platforms 2021–2022 RadarView™

The Government Cloud Platforms 2021–2022 RadarView™ addresses the need for government departments and agencies to leverage cloud platforms to accelerate their digital journeys, embrace the cloud, and identify the right cloud platform providers to partner with. The 33-page report also provides our point of view on how government cloud platform providers are catering to the changing needs of public sector agencies through a wide portfolio of products and services. Avasant delivers a general ranking for these providers based on the key dimensions of product maturity, enterprise adaptability, and future readiness.

November, 2021

-

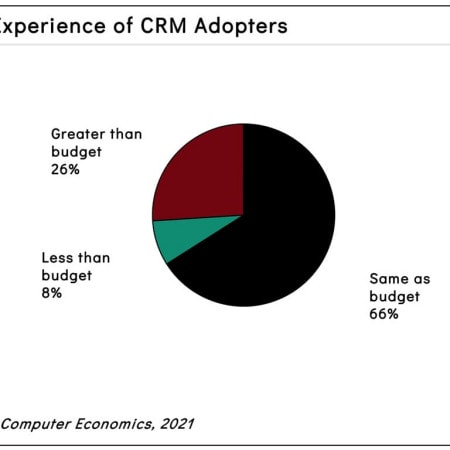

CRM Necessary but Messy

Customer relationship management systems are one of the most widely adopted categories of enterprise applications. But investing in a new CRM can be a messy business. As a core system, a CRM needs to interact with data across the entire business. Business processes should change to match the new capabilities. Hidden or unexpected costs can quickly add up, and missteps can result in a major setback, or worse, project failure. This Research Byte summarizes our full report on CRM Adoption Trends and Customer Experience.

September, 2021

-

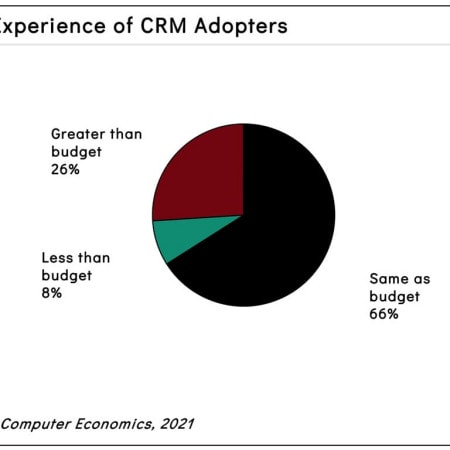

Digital CX and CRM Services 2021-2022 RadarView™

The Digital CX and CRM Services 2021-2022 RadarView™ provides information to assist enterprises in building digital customer experience (CX) and customer relationship management (CRM) strategies, charting out an action plan for CX transformation. It identifies key global service providers and system integrators that can help expedite a customer’s CX transformation journey. It also brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 80-page report also highlights key industry trends in the digital CX and CRM space and Avasant’s viewpoint on them.

October, 2021

-

CRM Adoption Trends and Customer Experience 2021

Customer relationship management (CRM) systems are one of the most widely adopted categories of enterprise applications, and investment in new CRM capabilities continues to grow. This report provides an overview of key concepts in the CRM space. We also examine CRM adoption and investment trends, showing how many organizations have the technology in place, how many are in the process of implementing it, and how many are expanding implementations. We then look at the return on investment (ROI) experience, total cost of ownership (TCO) experience, and which type of applications are the most popular. We conclude with recommendations to ensure CRM implementation success and to encourage user adoption.

September, 2021

-

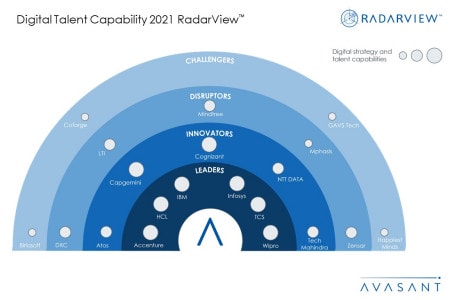

Digital talent to drive new wave of business transformation

Enterprises and IT service providers need to revisit their talent strategy and prioritize digital skills. The accelerated pace of digital transformation and a hybrid working environment have put a new emphasis on reskilling and upskilling the existing workforce. IT service providers are seeing 30% growth in deals involving digital technology like cloud and cybersecurity, and they have made significant investments in recruiting new talent, particularly in nearshore environments, closer to where the work originates. All of this pressure on an already thin talent pool requires planning, and perhaps a good partner. These emerging trends are covered in Avasant’s Digital Talent Capability 2021 RadarViewTM.

September, 2021

-

IT Spending and Staffing Benchmarks 2021/2022: Chapter 16: Government Sector Benchmarks

Chapter 16 provides benchmarks for government organizations. The 45 respondents in the sample range in size from about $50 million to $68 billion in annual revenue. The category includes city and county governments, federal and state agencies, law enforcement agencies, organizations that provide IT services to government agencies, and other government organizations.

July, 2021

-

IT Spending and Staffing Benchmarks 2021/2022: Chapter 28: City and County Government Subsector Benchmarks

Chapter 28 provides benchmarks for city and county governments. This chapter is concerned with the IT workings of city or county governments and not individual agencies within larger governments (which can be found in Chapter 29). The 25 respondents in this subsector have annual operating budgets ranging from $50 million to $68 billion.

July, 2021

-

Avasant Digital Forum: Accelerating the Journey to Digital Business Transformation Through SAP

The business world is evolving faster than ever, and companies need to transform to keep pace with their competitors. They need to become intelligent enterprises characterized by agile processes, elastic IT infrastructure and digital technologies.

December, 2021

-

Enabling Multi-Cloud Optimization, Innovation and Scale through FinOps in Partnership with HCL (Canada)

In today’s cloud-first world, businesses are struggling to catch up to the variable nature of cloud spending. While Multi-Cloud —with its scalability and flexibility—is a great enabler of innovation and digital transformation – it brings in a whole new set of management challenges. Operational teams can procure new cloud services without visibility into services already underutilized. Or they can forget to take down services when they are no longer needed. As a result, cloud spending can spiral out of control, and organizations can fail to realize the cost savings promised from the cloud model.

July, 2021

-

IT Spending and Staffing Benchmarks 2021/2022: Chapter 29: Government Agencies Subsector Benchmarks

Chapter 29 provides benchmarks for federal, state, and regional government agencies. The category includes public health agencies, courts and law enforcement agencies, organizations that provide IT services to government agencies, social service agencies, state parks, lotteries, and other federal, state, and regional government units. The 24 respondents in the sample have operating budgets that range in size from $62 million to about $40 billion.

July, 2021

-

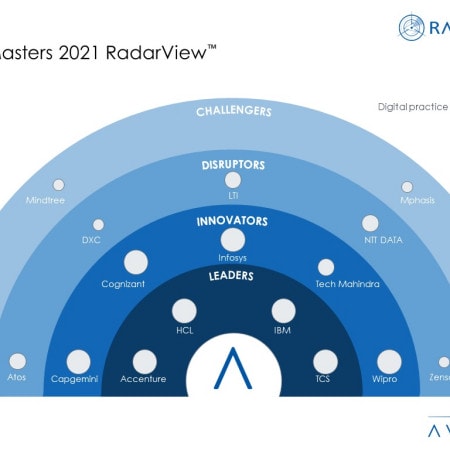

Digital transformation to propel enterprises into the new age

With a rapid shift to remote work, virtualization, touchless customer engagement, and agile supply chains, organizations are leapfrogging toward digitalization. The quest for survival in uncertain times and deriving greater business value is accelerating the adoption of digital technologies and solutions. By strengthening their digital foundation and offering bundled end-to-end transformation solutions, service providers are becoming a critical part of their customer’s digital journey. These emerging trends are covered in Avasant's Digital Masters 2021 RadarView™ report.

May, 2021

-

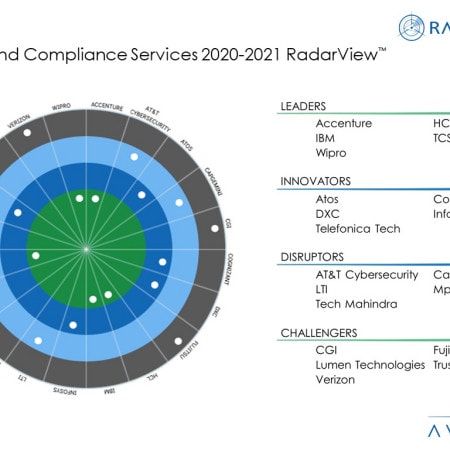

Business Agility and Resilience Drive Demand for Risk and Compliance Services

COVID-19 has emphasized the need for regulatory compliance, internal compliance controls, and the use of security frameworks and tools. Meanwhile, the regulatory environment is increasingly complex, particularly for multinational companies, as they struggle to comply with sometimes conflicting regulations across regions. Risks have changed with a growing cloud environment and increasingly diverse IT service portfolio. The need for a strong governance, risk, and compliance (GRC) partner has grown. These emerging trends are covered in Avasant's Risk and Compliance Services 2020-2021 RadarView™ report.

April, 2021

Grid View

Grid View List View

List View