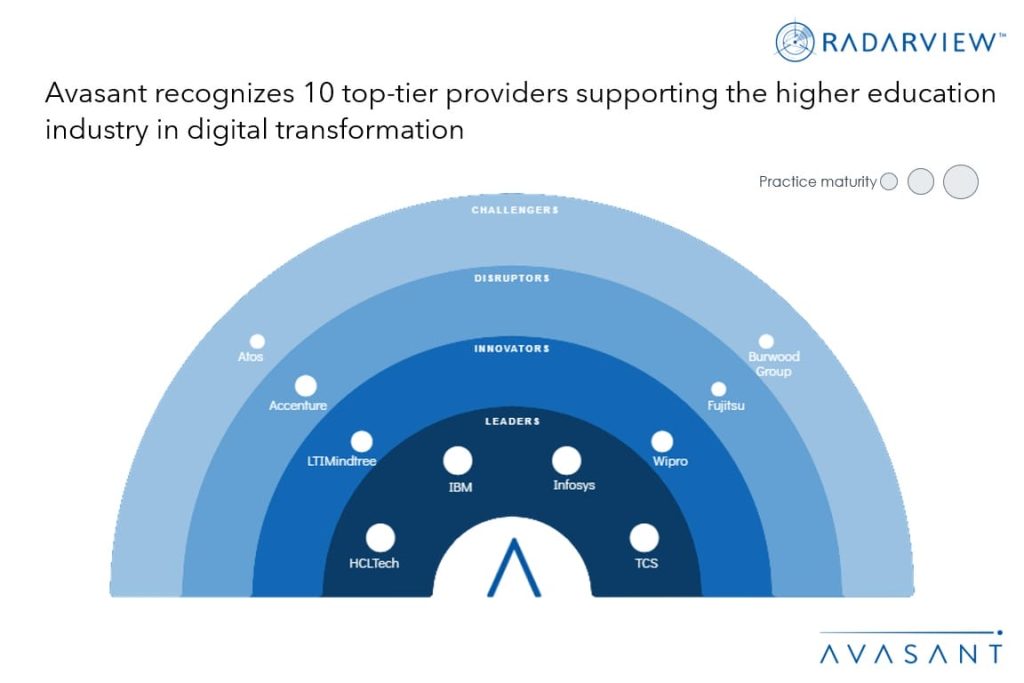

Over the past 12–18 months, customer-facing functions, enterprise applications, and processes have changed tremendously. There has been an uptake in digital channels, direct-to-consumer commerce, omnichannel digital communications, and SaaS-based application services. The period has also witnessed a rise in preference for data and AI-driven, personalized, and automated experiences. This Research Byte showcases how customers’ quest for enhanced personalization and seamless experiences has increased the demand for SaaS-based solutions for addressing industry-specific business needs and how service providers are facilitating this transformation in North America. We highlight the efforts of one such service provider, TCS, based on its recent analyst day in June 2023.