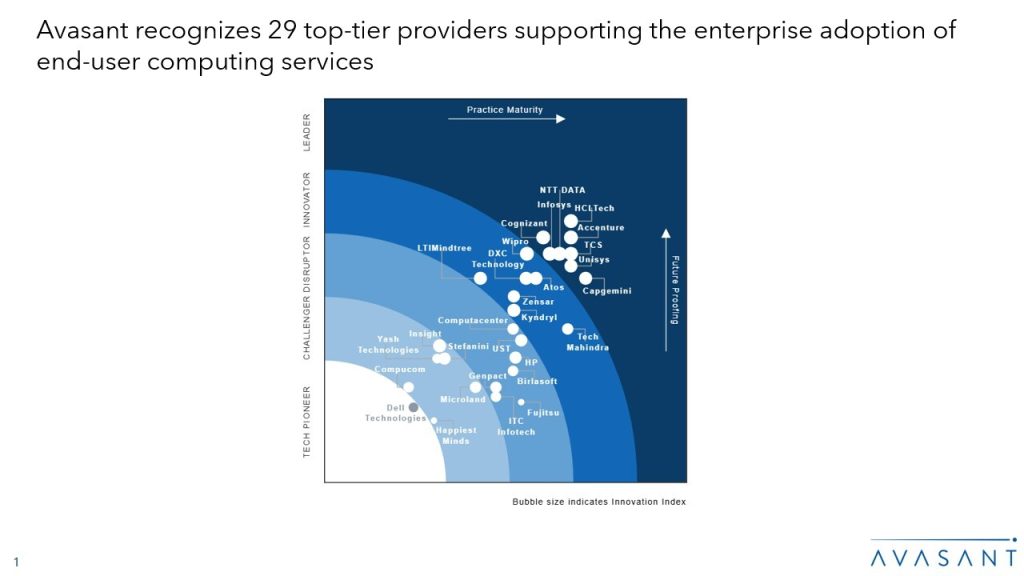

End-user computing (EUC) is shifting from device-centric, fragmented environments to a service-based, cloud-delivered operating model. Enterprises are adopting cloud PCs, unified platforms, and zero-touch life cycle management to simplify deployment, standardize operations, and reduce IT overhead. At the same time, end-user support is evolving from reactive, ticket-driven models to autonomous, AI-led service desks. In response, service providers are offering integrated EUC platforms that unify provisioning, device management, observability, and end-user support. Both demand-side and supply-side trends are covered in Avasant’s End-User Computing Services 2025–2026 Market Insights™ and End-User Computing Services 2025–2026 RadarView™, respectively.