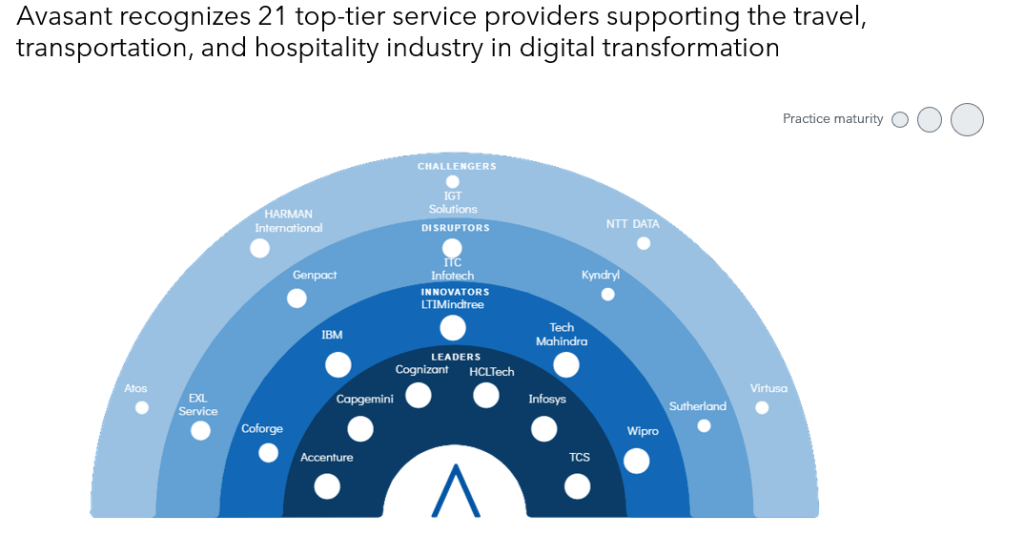

Travel, transportation, and hospitality enterprises increasingly invest in omnichannel experiences to enhance customer satisfaction across the entire value chain. These enterprises are streamlining routine operations and boosting business efficiency by harnessing advanced digital technologies such as generative AI, IoT, analytics, cloud computing, and intelligent automation. This strategic approach also involves rigorously re-evaluating their cybersecurity frameworks to effectively mitigate cyber threats. Simultaneously, these enterprises are committed to green initiatives, striving to achieve net-zero carbon emissions while advancing their operational goals. Both demand- and supply-side trends are covered in Avasant’s Travel, Transportation, and Hospitality Digital Services 2024 Market Insights™ and Travel, Transportation, and Hospitality Digital Services 2024 RadarView™, respectively.