Latest Reports

-

![Hard-to-Find Skills Keep IT Security Staffing Stagnant Trend in It Security Staff as a Percentage of IT Staff - Hard-to-Find Skills Keep IT Security Staffing Stagnant]()

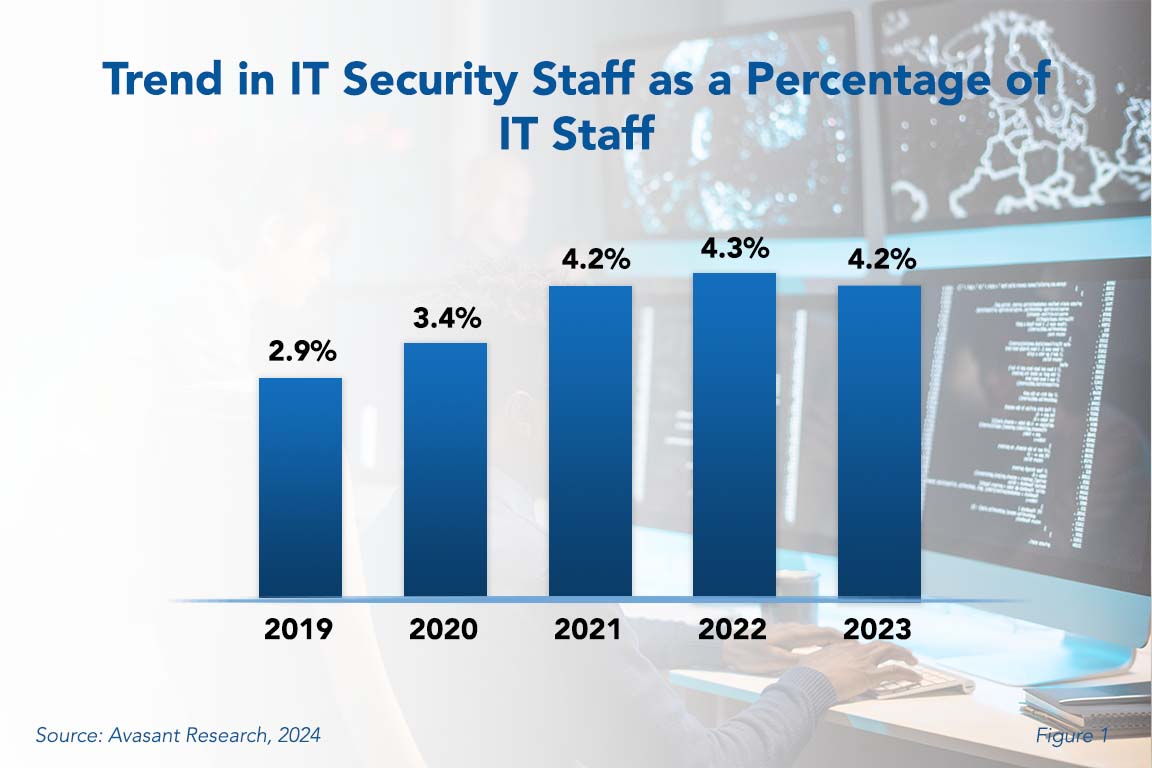

Hard-to-Find Skills Keep IT Security Staffing Stagnant

High-profile security attacks have increased the importance of security amongst enterprises over recent years. With the transformation of the workspace to remote and hybrid work, more pressure has been placed on IT security staffing personnel. Despite these increased burdens, this staffing ratio has remained relatively stable over the past three years.

February, 2024

-

![SCM Adoption Declines: Is the Supply Chain Hype Subsiding? SCM Adoption and Investment - SCM Adoption Declines: Is the Supply Chain Hype Subsiding?]()

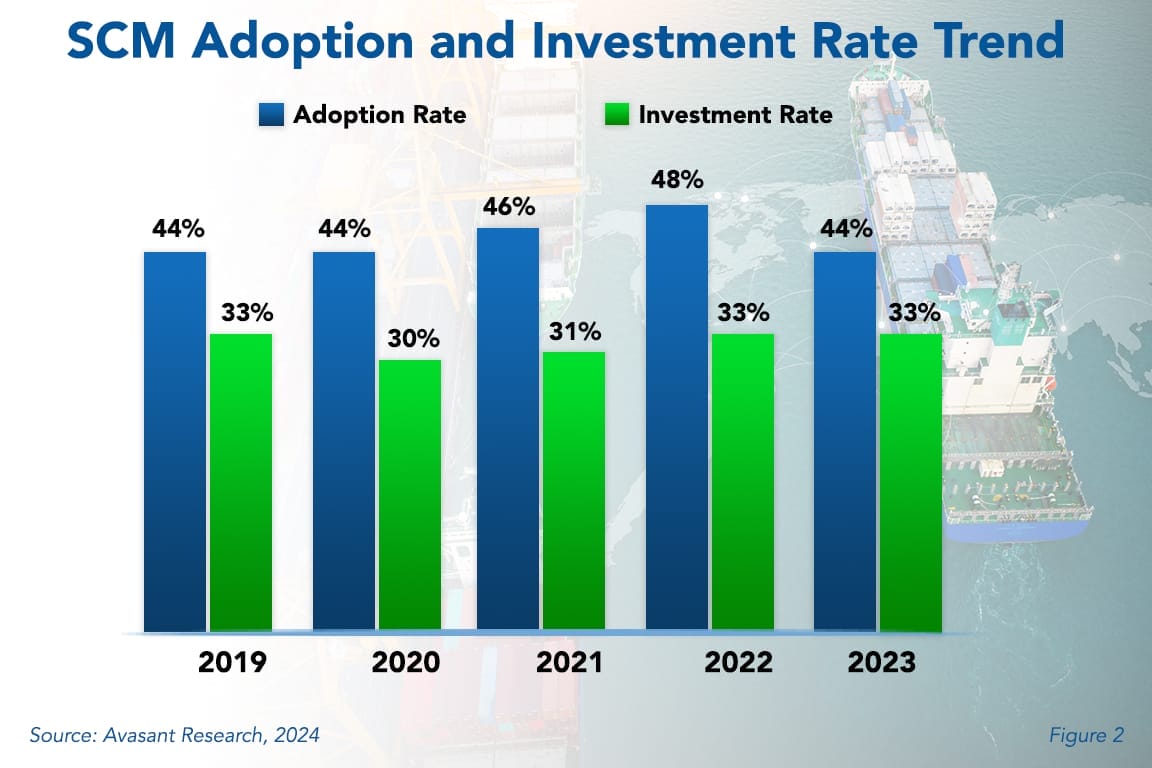

SCM Adoption Declines: Is the Supply Chain Hype Subsiding?

Previous global crises pushed supply chain management systems to the brink. Delays and shortages have led business leaders to question their longstanding commitment to lean inventory, just-in-time manufacturing, and reliance on long offshore supply chains. But with the changes of the economic environment in play, we have seen some normalization of supply chains. This Research Byte provides a summary of our full report on supply chain management adoption and customer experience.

February, 2024

-

![Microsoft Revs Up Copilot in Dynamics 365: Will it Fly with Customers? RB Product Image for website Copilot - Microsoft Revs Up Copilot in Dynamics 365: Will it Fly with Customers?]()

Microsoft Revs Up Copilot in Dynamics 365: Will it Fly with Customers?

To capitalize on the generative AI frenzy sweeping the business world, Microsoft has been rapidly launching versions of its Copilot solutions throughout its various products. The software giant has also announced many new use cases for Copilots in individual Dynamics 365 modules. But are customers ready and willing to let Gen AI play such an important role in their core ERP processes? And are they willing to pay for it? We examine the Copilot state of play.

February, 2024

-

![Airlines and Airports Digital Services: Employing Emerging Technologies to Augment Passenger Experience MoneyShot AA Digital Services 2024 - Airlines and Airports Digital Services: Employing Emerging Technologies to Augment Passenger Experience]()

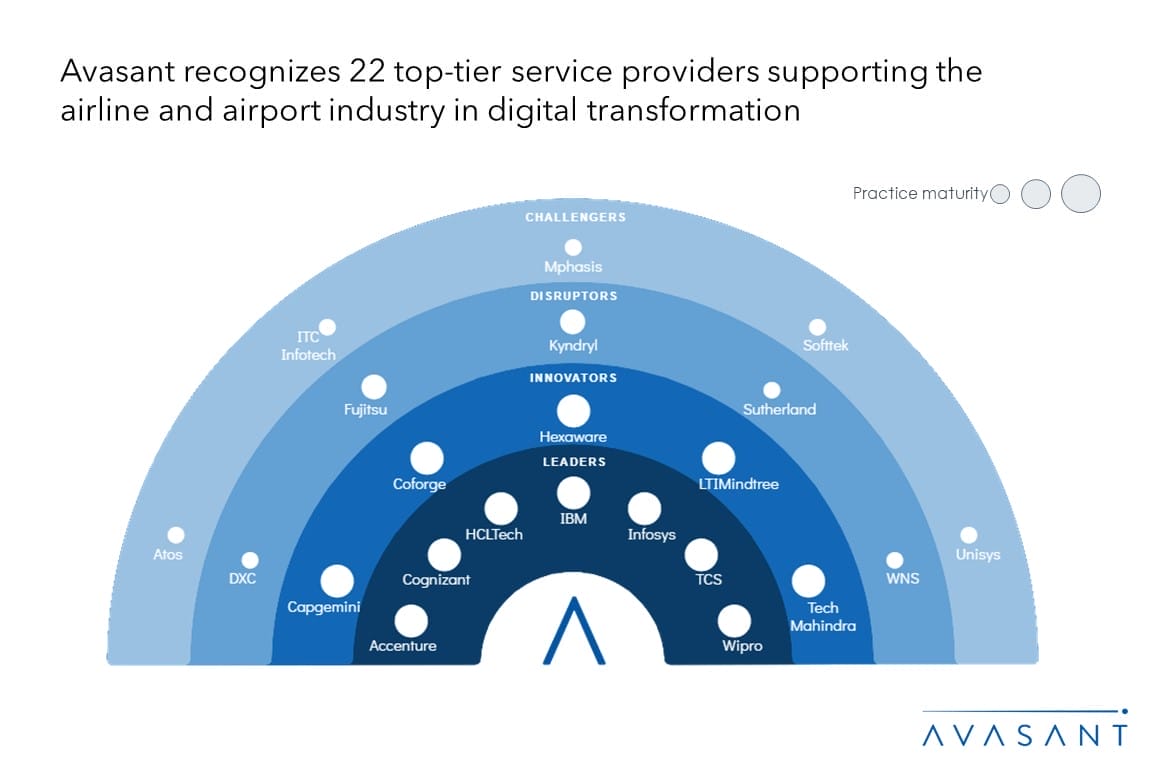

Airlines and Airports Digital Services: Employing Emerging Technologies to Augment Passenger Experience

Airline and airport enterprises are investing in digital technologies to enhance customer experience and improve operational efficiency. Additionally, to meet the evolving demands of the market, the industry is embracing ESG measures across the value chain to achieve net-zero emissions and address customer preference for sustainable travel. Furthermore, emerging technologies, especially AI, Cloud, and Intelligent automation, are significantly instrumental in transforming the industry to offer self-help kiosks, modernize legacy IT infrastructure, and improve workforce efficiency by automating mundane tasks. Both demand- and supply-side trends are covered in Avasant’s Airlines and Airports Digital Services 2024 Market Insights™ and Airlines and Airports Digital Services 2024 RadarView™, respectively.

February, 2024

-

![NetOps Outsourcing Continues Its Ascent Outsourcing Frequency Application Network Operations - NetOps Outsourcing Continues Its Ascent]()

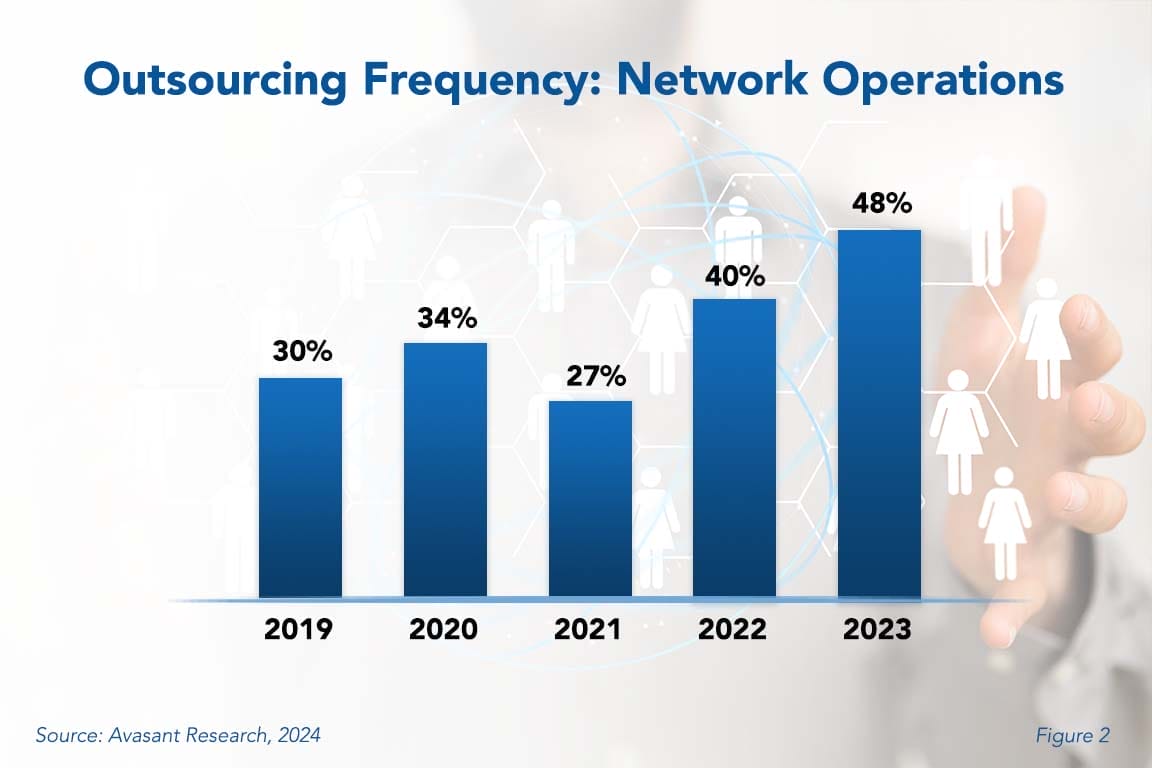

NetOps Outsourcing Continues Its Ascent

As applications, data, and infrastructure become more complex and more infrastructure shifts to the cloud, organizations will seek help with their network operations. Moreover, network service diversification and virtualization are driving the demand for more full-stack skill sets from engineers. This is likely to push the idea of outsourcing network operations. This Research Byte summarizes our full report on Network Operations Outsourcing Trends and Customer Experience.

February, 2024

-

![App Development Outsourcing Increasing But for How Long? Outsourcing Frequency Application Developement - App Development Outsourcing Increasing But for How Long?]()

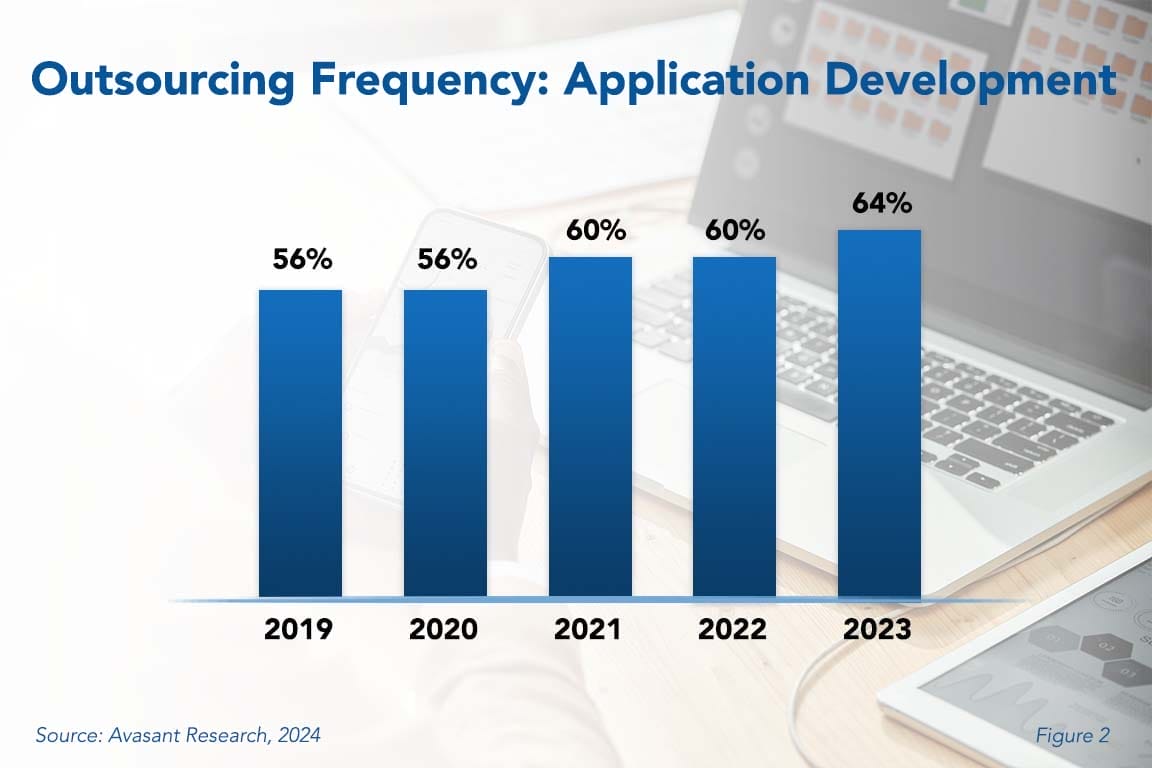

App Development Outsourcing Increasing But for How Long?

The outsourcing of the application development function has grown in the past five years, increasing from 56% in 2019 to 64% in 2023. However, this is an outsourcing category that should be monitored, because there are countervailing trends such as public cloud infrastructure, SaaS, low-code/no-code, and even AI, which may result in decreased demand for developers in the near future. This Research Byte summarizes our full report on Application Development Outsourcing Trends and Customer Experience.

February, 2024

-

![Breakthrough Innovation through Digitalization in the Life Sciences Domain MoneyShot 1 Life Sciences 2024 RadarView - Breakthrough Innovation through Digitalization in the Life Sciences Domain]()

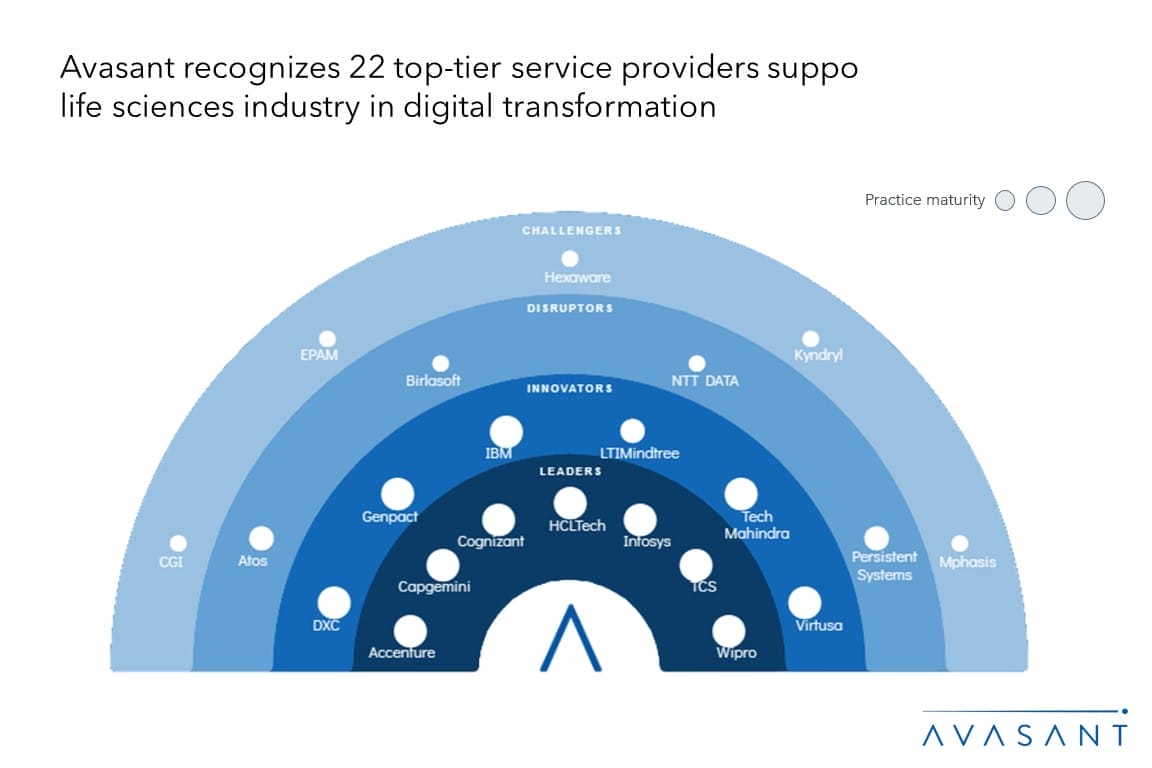

Breakthrough Innovation through Digitalization in the Life Sciences Domain

The Life Sciences Digital Services 2024 RadarView™ can help life sciences enterprises craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid them in identifying the right partners and service providers to accelerate their digital transformation in this space. The 86-page report also highlights top market trends in the life sciences industry and Avasant’s viewpoint.

February, 2024

-

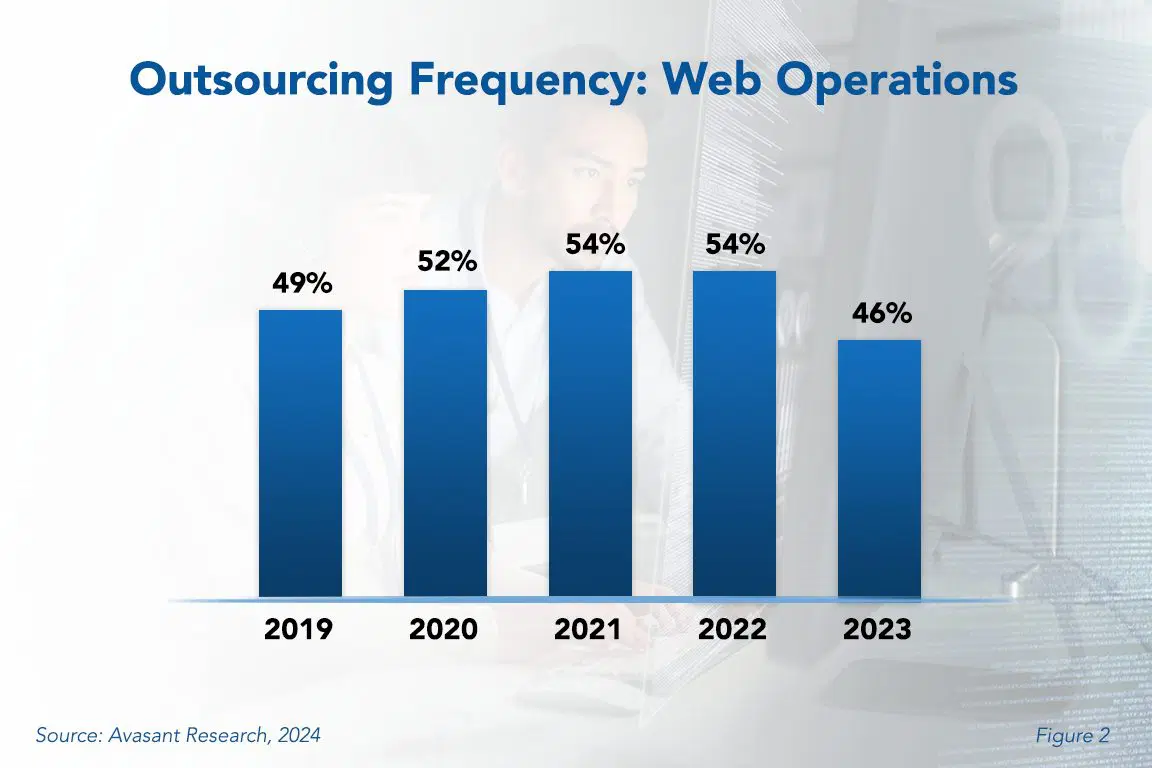

![Increased Automation Reduces Web Operations Outsourcing Outsourcing Frequency v1 - Increased Automation Reduces Web Operations Outsourcing]()

Increased Automation Reduces Web Operations Outsourcing

Web operations outsourcing is a well-known managed service in which organizations continue to expand their efforts. This shift toward web-enabled business processes and e-commerce has prompted many companies to reassess their online strategies. Many have turned to managed service providers to deliver highly available and reliable web and e-commerce systems. However, the rise in automated solutions and perhaps even generative AI may have given companies the confidence to tackle these tasks on their own. This Research Byte summarizes our full report on Web Operations Outsourcing Trends and Customer Experience.

February, 2024

-

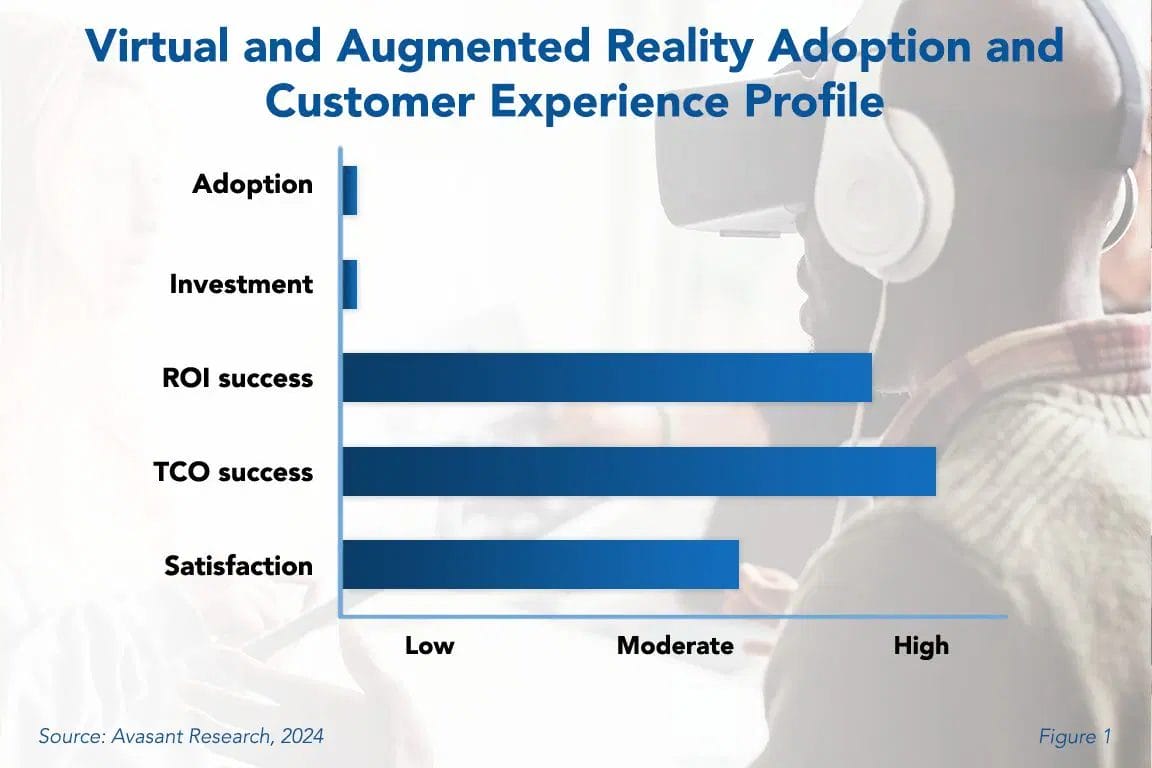

![VR/AR Adoption Low, For Now AR VR v1 - VR/AR Adoption Low, For Now]()

VR/AR Adoption Low, For Now

Businesses are in the early stages of adopting virtual reality and augmented reality (VR/AR) solutions. While widespread adoption of VR/AR has not yet fully materialized, businesses are actively experimenting with these technologies. However, the ROI and TCO are favorable for early adopters. This Research Byte summarizes our full report, Virtual and Augmented Reality Adoption Trends and Customer Experience.

February, 2024

-

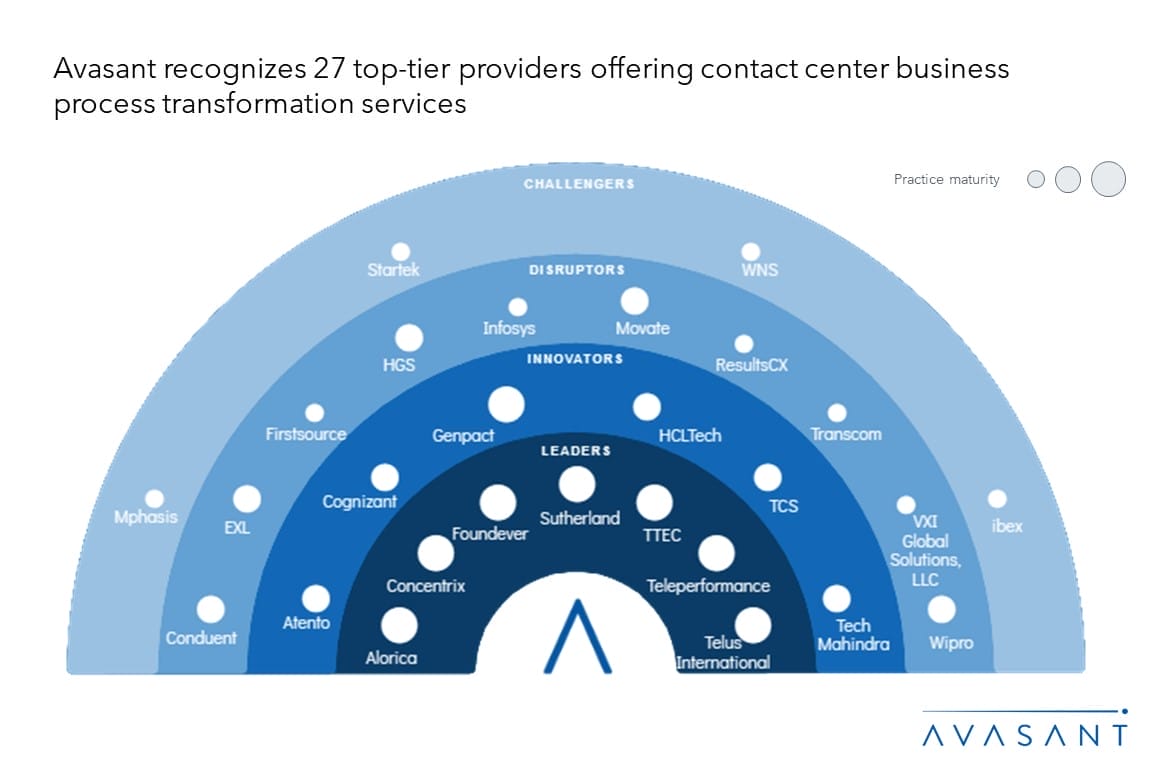

![Finding the Synergy Between AI Capabilities and Human Agents to Enhance Customer Experience MoneyShot Contact Center Processing BPT 2023 2024 - Finding the Synergy Between AI Capabilities and Human Agents to Enhance Customer Experience]()

Finding the Synergy Between AI Capabilities and Human Agents to Enhance Customer Experience

Enterprises are strategically aligning their priorities to emphasize customer experience while concurrently optimizing costs. This approach has fueled the surge in nearshore outsourcing, underpinned by considerations such as data security, cultural alignment, and the imperative for swifter response times. The increased usage of digital channels, coupled with the integration of generative AI and cloud-based solutions, signifies a paradigm shift in the contact center outsourcing landscape. This technology integration is poised to drive the growth of contact center services as organizations increasingly seek tailored solutions by leveraging data-driven insights to navigate the intricate dynamics of the contemporary business environment. Demand-side and supply-side trends are covered in our Contact Center Business Process Transformation 2023–2024 Market Insights™ and Contact Center Business Process Transformation 2023–2024 RadarView™, respectively.

January, 2024

-

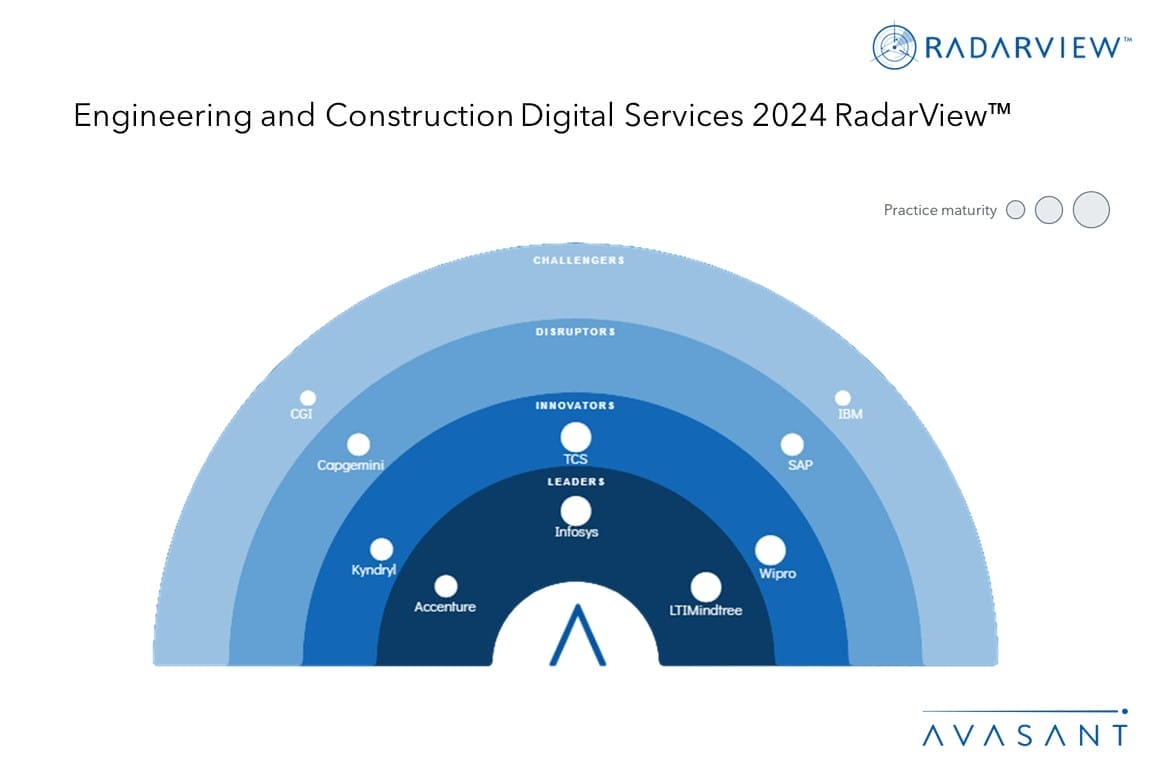

![Transforming Legacy Construction Processes Using Digital Technology MoneyShot EC 2024 RadarView - Transforming Legacy Construction Processes Using Digital Technology]()

Transforming Legacy Construction Processes Using Digital Technology

In the face of challenges such as cost pressures, climate compliance needs, labor shortages, and supply chain disruptions, the engineering and construction industry is aggressively pouring digital investments and adopting cutting-edge technologies — generative AI, advanced analytics, digital twin, and virtual reality — to address these challenges. Leveraging connected construction platforms, project management solutions, drone-based inspections, and modular construction, they aim to enhance project efficiency, reduce costs, and prioritize worker safety and technology usability. As this requires strong technological expertise and delivery capabilities, engineering and construction enterprises are collaborating with service providers for digital transformation. Both demand-side and supply-side trends are covered in our Engineering and Construction Digital Services 2024 Market Insights™ and Engineering and Construction Digital Services 2024 RadarView™, respectively.

January, 2024

-

![Reinventing Digital Commerce through Infrastructure Upgrade and Next-Gen Commerce MoneyShot Digital Commerce Services 2023 2024 - Reinventing Digital Commerce through Infrastructure Upgrade and Next-Gen Commerce]()

Reinventing Digital Commerce through Infrastructure Upgrade and Next-Gen Commerce

Enterprises are increasingly shifting their focus from traditional e-commerce models like B2B and B2C to D2C, B2B2C, and online marketplaces to increase market reach and drive business agility and growth. To enable this, they are adopting new order fulfillment strategies that help reshape digital commerce operations, boost delivery speeds, and reduce costs. They are also upgrading their legacy digital commerce infrastructure and uplifting customer engagement through next-generation commerce to drive scalability and flexibility. Further, personalization boundaries are being pushed by digital commerce platform vendors who integrate generative AI capabilities in their current solutions. Aligned with these trends, service providers’ priorities are underscored by investments in next-generation commerce, expanding partner ecosystems, and practice growth. Both demand- and supply-side trends are covered in Avasant’s Digital Commerce Services 2023–2024 Market Insights™ and Digital Commerce Services 2023–2024 RadarView™, respectively.

January, 2024