-

Ciklum: Shaping the Future of Custom Product Development

Software and smart sensors are being used increasingly in products and services today. And not just in high-tech products. Even low-tech products are becoming smart products. And organizations in all industries are increasingly leveraging technology to better reach and serve customers, whether it be through e-commerce, mobile apps, or connected devices. As a result, product design, hardware design, and software development must all be done in coordination and collaboration. Ciklum is a leading provider in this custom product development space and is a Tech Innovator to watch.

November, 2023

-

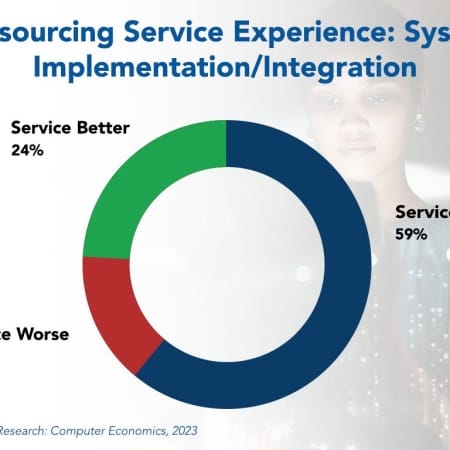

System Implementation/Integration Outsourcing Trends and Customer Experience 2023

System implementation/integration outsourcing is the use of an external service provider to assist in implementing new systems, which often includes integration with other new or existing systems. A systems integration (SI) firm can help or be responsible for some or all of the following: identifying system requirements, understanding and redesigning business processes, selecting a new system, and deploying the system.

November, 2023

-

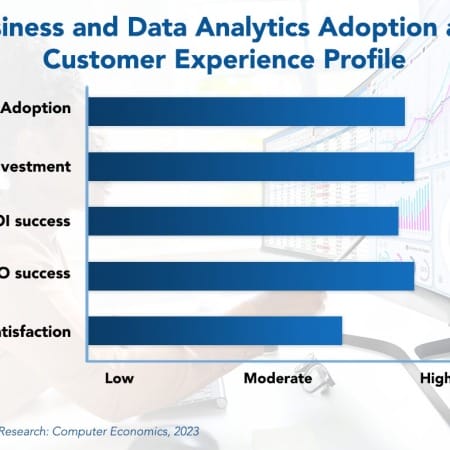

Business and Data Analytics Adoption Trends and Customer Experience 2024

Enterprises may be entering a new paradigm when it comes to business and data analytics. This may be characterized as the third phase of data usage inside the IT department. First came the use of retrospective data, where data was collected and used to analyze and understand previous performance. Second came predictive analytics, where past data was used to predict the future and make enterprise decisions. Most organizations are still mastering this phase.

December, 2023

-

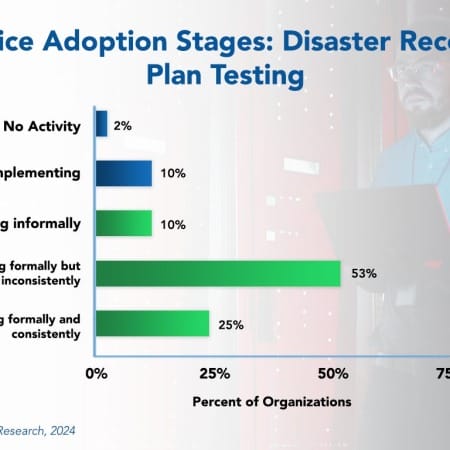

Disaster Recovery Plan Testing Best Practices 2024

In today’s unpredictable business environment, there is an increasing reliance on data and digital systems to operate efficiently. With this comes the need for robust disaster recovery (DR) plans and testing to reduce the impact of unforeseen events. The effectiveness of a DR plan can only be truly validated through routine testing. However, while this practice is growing, few organizations are testing their DR plans formally and consistently. This Research Byte summarizes our full report on disaster recovery plan testing as a best practice.

January, 2024

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 9: Wholesale Distribution Sector Benchmarks

Chapter 9 provides benchmarks for wholesale distributors. The category includes wholesale distributors of building products, home furnishings, home improvement products, auto parts, industrial components, fuel supply, electronics, food and beverage, and other products. The 31 respondents in the sample range in size from a minimum of about $50 million to $10 billion in revenue.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 36: Government Agencies Subsector Benchmarks

Chapter 36 provides benchmarks for federal, state, and regional government agencies. The category includes public health agencies, courts and law enforcement agencies, organizations that provide IT services to government agencies, social service agencies, state parks, and other federal, state, and regional government units. The 21 respondents in the sample have operating budgets that range in size from about $62 million to about $40 billion.

July, 2023

-

IT Spending and Staffing Benchmarks 2023/2024: Chapter 33: Professional Services Subsector Benchmarks

Chapter 33 provides benchmarks for professional services organizations. The 20 respondents in the sample range in size from a minimum of about $50 million to about $2 billion in annual revenue. The sector includes firms that provide professional services, including legal, accounting, financial advice, consulting, marketing, and other services.

July, 2023

-

European IT Spending and Staffing Benchmarks 2023/2024: Chapter 12: Professional and Technical Services Sector Benchmarks

Chapter 12 provides benchmarks for professional and technical services organizations. The 45 respondents in the sample range in size from a minimum of about €50 million to about €80 billion in annual revenue. The sector includes firms that provide professional and technical services, including engineering, legal, accounting, financial advice, consulting, marketing, research, and other services.

September, 2023

-

Generative AI Strategy, Spending, and Adoption Metrics 2024: Chapter 4: Retail Sector Benchmarks

This chapter provides generative AI metrics for the retail sector. It features a sample of 15 retailers including department stores, apparel retailers, multinational brick-and-mortar chains, toys, and office supplies, as well as online retailers. It includes metrics on how much enterprises are spending on generative AI, where they are spending it, and how they are governing it.

December, 2023

-

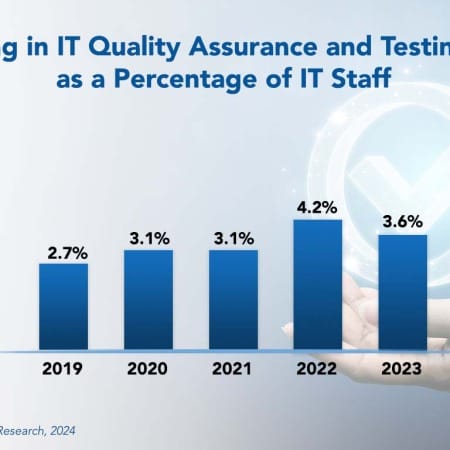

IT Quality Assurance and Testing Staffing Ratios 2024

IT quality assurance and testing has always been a vital role in IT organizations. However, the role of quality assurance as a discrete job position has changed significantly. In 2023, the percentage of quality assurance and testing staff as a percentage of the total IT staff dropped to 3.6% from 4.2% in 2022.

February, 2024

-

Vendor Discount Report October 2023

The largest and best discounts are often only offered to the vendors’ best customers, and buyers may find it difficult to determine whether the discount offered is typical or whether a better deal can be negotiated. The Vendor Discounts Report is designed to give procurement personnel, lessors, lessees, and departmental manager’s insight and guidance regarding current discount structures on a variety of categories of equipment in the marketplace.

October, 2023

-

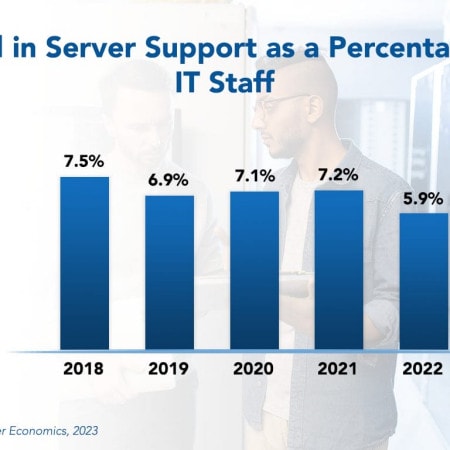

Server Support Staffing Dips as IT Infrastructure Gets Easier to Administer

The demand for server support administrators has been on a downward trend for a decade. Virtualization, automation, DevOps, and the cloud have made IT infrastructure easier to administer. As a result, the IT infrastructure support burden is lessening, although there are factors also working in the other direction. This Research Byte examines the reasons for the trend and provides a summary of our full report on Server Support Staffing Ratios.

April, 2023

-

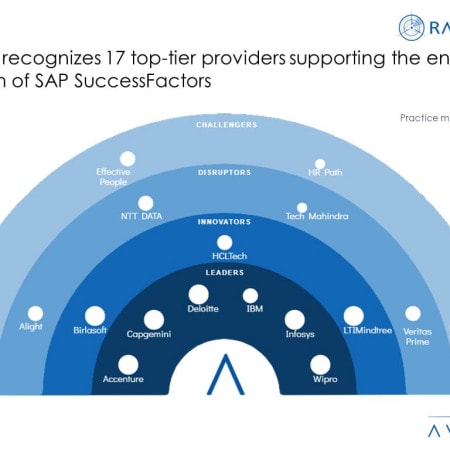

Transforming HR Operations to Improve Productivity and Accountability

Enterprises are replacing their discrete HR solutions with a unified people management platform as it helps address multiple business challenges such as workflow redundancy, data visibility issues, and process inefficiencies. Organizations leverage digital tools and accelerators with modular designs to accelerate their transition to SAP SuccessFactors and address additional use cases such as automated data migration, compliance management, and industry-specific workflow creation. Additionally, enterprises focus on improving scalability and offering employee self-service options. Companies leverage automation solutions and interactive design interfaces to optimize HR functions and improve user adoption. Both demand-side and supply-side trends are covered in our SAP SuccessFactors Services 2023 Market Insights™ and SAP SuccessFactors Services 2023 RadarView™, respectively.

May, 2023

-

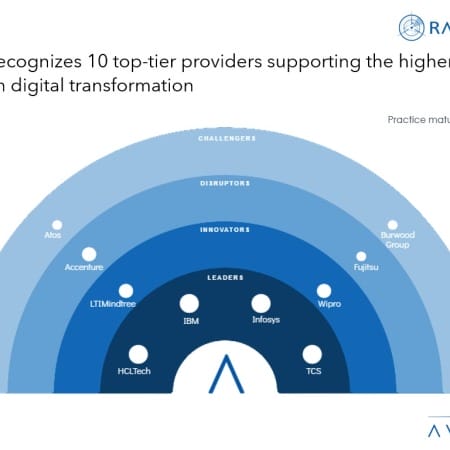

Higher Education Digital Services: Leveraging Digital Transformation to Facilitate Online and Lifelong Learning

To adapt to evolving customer demands, higher education institutes are gravitating toward digital technologies to provide personalized and immersive experiences to students and provide a blended learning experience. Higher education institutes are leveraging AI, analytics, cloud, and AR/VR to provide customized content and support to students. Institutes are also putting emphasis on lifelong learning and continuing education to enable employees to upskill and reskill throughout their professional journeys. Both demand- and supply-side trends are covered in Avasant’s Higher Education Digital Services 2023–2024 Market Insights™ and Higher Education and Entertainment Digital Services 2023–2024 RadarView™, respectively.

July, 2023

-

Generative AI – Opportunities and Challenges

Although artificial intelligence originated in academic research in the 1950s, only recently has it captured the imagination of the general public. This has everything to do with the release of ChatGPT, putting a powerful tool in the hands of individual consumers. But what are the opportunities it brings to businesses? And what are the challenges we face in using it? To answer these questions, Avasant Senior Partner Frank Scavo recently conducted a video interview on this subject. This Research Byte provides a link to the full interview.

August, 2023

Grid View

Grid View List View

List View