-

The Quantum Revolution in India: Betting Big on Quantum Supremacy

In the last decade, quantum technologies have transitioned from science fiction to real-world enterprise trials. Quantum computing has evolved, providing real-time analytics, faster decision-making, better forecasting, quicker prototyping, and new products creation. India aims to address issues concerning national priorities using quantum technologies. The government has planned an over USD 1B outlay to build a quantum-enabled infrastructure. The infrastructure will focus on converting theoretical aspects of quantum into commercial prospects.

February, 2022

-

F&A Business Process Transformation 2021–2022 RadarView™

The F&A Business Process Transformation 2021–2022 RadarView™ aims to help enterprises identify the correct finance digital transformation partner by detailing service capability and offering a portfolio of leading providers in the F&A space. It provides an all-encompassing view of key F&A service providers under three broad parameters of practice maturity, domain ecosystem, and investments and innovation. The 72-page report also highlights key industry trends in the F&A outsourcing space and Avasant’s viewpoint on them.

January, 2022

-

Digital Commerce Services 2021–2022 RadarView™

The Digital Commerce Services 2021–2022 RadarView™ provides information to assist enterprises in building an integrated digital commerce strategy and charting out an action plan for digital commerce transformation. It identifies key global service providers and system integrators that can help expedite a customer’s commerce transformation journey. It also brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 67-page report also highlights key industry trends in the digital commerce space and Avasant’s viewpoint on them.

January, 2022

-

Global Hire-to-Retire Business Process Transformation 2021-2022 RadarView™

The Global Hire-to-Retire Business Process Transformation 2021-22 RadarView™ assists organizations in identifying strategic partners for digital HR transformation by featuring detailed capability and experience analyses of leading service providers. It provides a 360-degree view of key HR service providers across practice maturity, domain ecosystem, and investments and innovations, thus helping enterprises in evaluating leading players in the HR space. The 70-page report also highlights top market trends in the HR outsourcing arena and Avasant’s viewpoint on them.

December, 2021

-

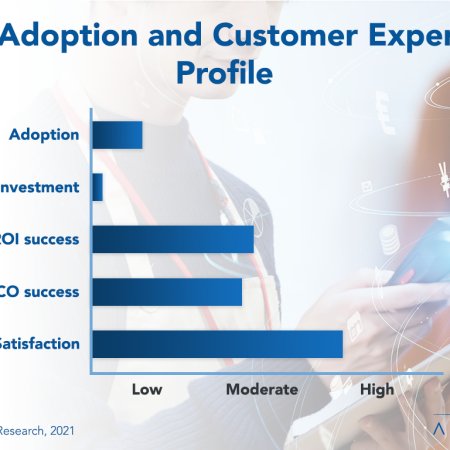

RFID Adoption Trends and Customer Experience 2021

Radio-frequency identification is gaining ground in certain industry sectors and applications where its benefits are clear. Although RFID may one day become even more widespread than barcodes, it will take longer than its advocates hope for. This report quantifies the current adoption and investment trends for RFID technology as well as the benefits driving companies to expand their RFID implementations. We assess these trends by organization size and sector and examine the ROI and TCO experiences of adopters. We conclude with practical advice for planning new investments in RFID technologies.

December, 2021

-

Oracle Cloud ERP Services 2021–2022 RadarView™

The Oracle Cloud ERP Services 2021–2022 RadarView™ helps enterprises define their approach for Oracle Cloud ERP adoption and identify the right implementation partner to support them in their journey. It assesses implementation services providers based on their ability to offer services with limited disruption. The 75-page report also provides our point of view on how Oracle Cloud ERP implementation service providers are catering to the changing needs of enterprises through a multitude of customized frameworks, proprietary tools, and platforms, thus delivering a general ranking based on key dimensions of practice maturity, partner ecosystem, and investment and innovation.

December, 2021

-

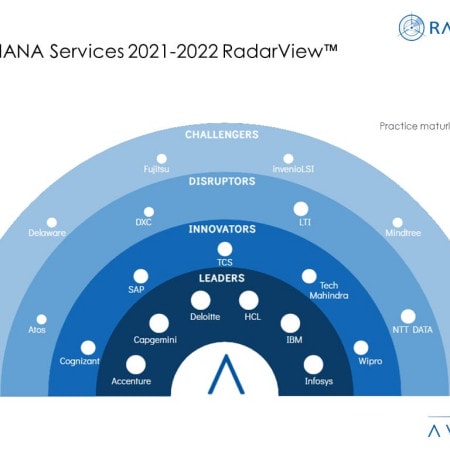

SAP S/4HANA Services 2021–2022 RadarView™

The SAP S/4HANA Services 2021–2022 RadarView™ helps enterprises define their approach for SAP S/4HANA adoption and identify the right implementation partner to support them in their journey. It assesses implementation services providers based on their ability to offer services with limited disruption. The 71-page report also provides our point of view on how SAP S/4HANA implementation service providers are catering to the changing needs of enterprises through a wide portfolio of accelerators and preconfigured solutions, thus delivering a general ranking based on key dimensions of practice maturity, partnership ecosystem, and investment and innovation.

November, 2021

-

Intelligent ITOps Services 2021–2022 RadarView™

The Intelligent ITOps Services 2021–2022 RadarView™ assists organizations in identifying strategic partners for IT operations by featuring detailed capability and experience analyses of leading service providers. It provides a 360-degree view of key intelligent ITOps service providers across practice maturity, partner ecosystem, and investments and innovation, thus supporting enterprises in identifying the right intelligent ITOps service partner. The 80-page report also highlights top market trends in the intelligent ITOps space and Avasant’s viewpoint.

October, 2021

-

High-Tech Industry Digital Services 2021–2022 RadarView™

The High-Tech Industry Digital Services 2021–2022 RadarView™ addresses the need for enterprises to understand the right action points to gain competitive advantage. It also identifies key service providers and system integrators that can help enterprises in their business transformation. It also brings out detailed capability and experience analyses of leading vendors to assist high-tech companies in identifying strategic partners for their digital transformation journeys. The 91-page report also highlights key industry trends and the industry outlook in the high-tech space and Avasant’s viewpoint on them.

October, 2021

-

Intelligent Document Processing Platforms 2021-2022 RadarView™

The Intelligent Document Processing Platforms 2021-2022 RadarView™ assists organizations in identifying strategic partners for IDP by featuring detailed capability and experience analyses of leading platform providers. It provides a 360-degree view of key IDP platform providers across product maturity, enterprise adaptability, and future readiness, thus supporting enterprises in identifying the right IDP platform partner. The 57-page report also highlights top market trends in the IDP space and Avasant’s viewpoint.

October, 2021

-

Digital Acceleration Key to Increase Resilience – A/NZ market

The drive towards digitization due to COVID-19 has changed the nature of IT engagement and outsourcing. It is no different in the case of the Australia and New Zealand (ANZ) market, where clients are facing budget constraints and shorter decision-making windows. Their business strategies are increasingly underpinned by use of multiple digital technologies to cater to changing consumer demand. And, they are responding by consolidating their vendor ecosystems and taking a holistic approach rather than a siloed or individual solution-based view. This article builds on findings from the Wipro Australia and New Zealand Analyst and Advisory Day as well as Avasant Research.

October, 2021

Grid View

Grid View List View

List View