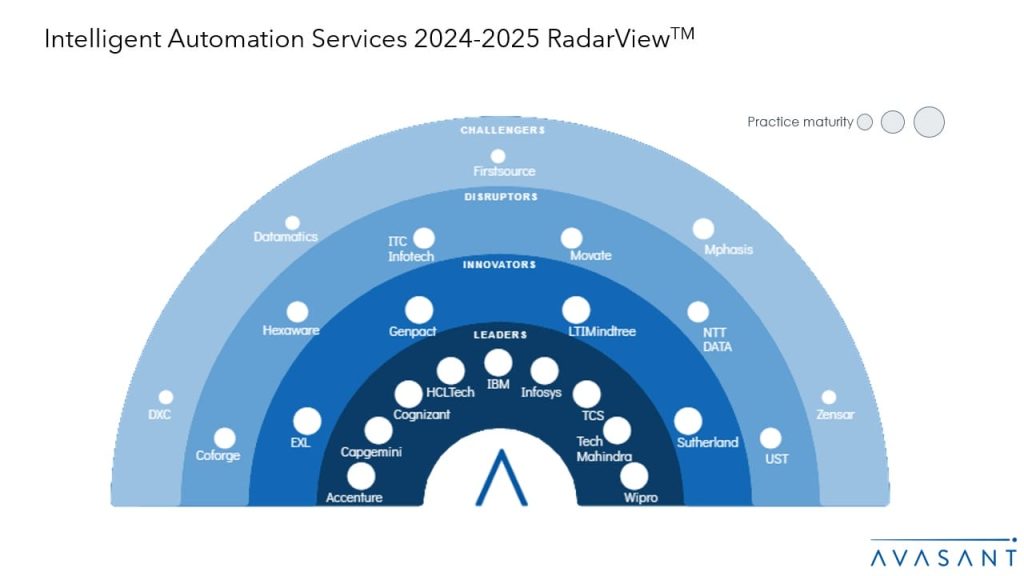

Advancements in AI and generative AI technologies such as synchronous AI agents, copilots, and autonomous visual reasoning tools, like Anthropic’s computer use, are revolutionizing the automation landscape. Enterprises are increasingly focusing on automating complex use cases that traditionally required intensive human intervention, including customer experience management, sales lead qualification, and real-time decision-making tasks. This shift has prompted organizations to elevate their investments in automation, prioritizing the development of truly touchless workflows capable of handling intricate processes. By leveraging these advanced AI capabilities, enterprises can achieve seamless integration, scalability, and higher operational efficiency. Both demand-side and supply-side trends are covered in Avasant’s Intelligent Automation Services 2024–2025 Market Insights™ and Intelligent Automation Services 2024–2025 RadarView™, respectively.