-

Google’s Latest Move in Building Out its Security Platform Offering

The rising threat landscape has led cloud service providers to expand the scope of their cybersecurity offerings to multiple data sources and automate the triage process and incident response. This includes the use of artificial intelligence/machine learning to model the behavior of attackers and identify threats in advance. By acquiring Mandiant and Siemplify, Google is taking a big step in its vision of “invisible security” with automated threat hunting, detecting, and response. This will allow CISOs to capitalize on the SIEM-to-SOAR maturity trend for streamlining their threat response procedures.

March, 2022

-

The Quantum Revolution in India: Betting Big on Quantum Supremacy

In the last decade, quantum technologies have transitioned from science fiction to real-world enterprise trials. Quantum computing has evolved, providing real-time analytics, faster decision-making, better forecasting, quicker prototyping, and new products creation. India aims to address issues concerning national priorities using quantum technologies. The government has planned an over USD 1B outlay to build a quantum-enabled infrastructure. The infrastructure will focus on converting theoretical aspects of quantum into commercial prospects.

February, 2022

-

Wipro’s Edgile Acquisition: Another Step in the Right Direction for Wipro’s Cybersecurity Aspirations

IT service providers are looking to own the end-to-end cybersecurity adoption cycle and be part of the executive decision-making. This implies going beyond regular implementation and managed security services and offering consultancy and advisory services. Through Edgile, Wipro aims to achieve the following two goals: move up the value chain by playing an influential role in the initial stages of deals, which involve decision-making at the board or CXO leveland position itself as an end-to-end service provider by augmenting its cybersecurity consulting capabilities and covering the entire value chain.

February, 2022

-

Healthcare Payor Digital Services 2022–2023 RadarView™

The Healthcare Payor Digital Services 2022–2023 RadarView™ can help payors craft a robust strategy based on industry outlook, best practices, and digital transformation. The report can also aid in identifying the right partners and service providers to accelerate digital adoption. The 96-page report also identifies key service providers and system integrators that can help enterprises in their digital transformation.

January, 2022

-

Leading with a Unified and Integrated Approach to the Cloud – The New Way to Stay Ahead in the Cloud Services Market

The change in customer behavior brought on by the pandemic became the perfect platform for service providers to offer integrated cloud solutions by bringing together their consulting and advisory services, domain expertise, and deep engineering capabilities. Over the past 12 to 18 months, several leading service providers stepped up to enable enterprises to redesign their infrastructure from the core. This report discusses how Wipro followed this trend by introducing Wipro FullStride Services for its customers. As part of its cloud strategy, in July 2021, Wipro introduced Wipro FullStride Cloud Services to strengthen its position as a full-stack service provider that looks at personas, processes, data, apps, and infrastructure. The company has been advancing its cloud initiatives and plans to invest USD 1 billion over the next three years in technology, acquisitions, people, and partnerships.

January, 2022

-

F&A Business Process Transformation 2021–2022 RadarView™

The F&A Business Process Transformation 2021–2022 RadarView™ aims to help enterprises identify the correct finance digital transformation partner by detailing service capability and offering a portfolio of leading providers in the F&A space. It provides an all-encompassing view of key F&A service providers under three broad parameters of practice maturity, domain ecosystem, and investments and innovation. The 72-page report also highlights key industry trends in the F&A outsourcing space and Avasant’s viewpoint on them.

January, 2022

-

Digital Commerce Services 2021–2022 RadarView™

The Digital Commerce Services 2021–2022 RadarView™ provides information to assist enterprises in building an integrated digital commerce strategy and charting out an action plan for digital commerce transformation. It identifies key global service providers and system integrators that can help expedite a customer’s commerce transformation journey. It also brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 67-page report also highlights key industry trends in the digital commerce space and Avasant’s viewpoint on them.

January, 2022

-

Blockchain Services 2021–2022 RadarView™

The Blockchain Services 2021– 2022 RadarView™ provides information to assist enterprises in identifying key application areas and use cases and developing a strategy around blockchain adoption. It helps organizations in charting out an action plan to drive blockchain initiatives. The report identifies key blockchain service providers who can help companies expedite business transformation leveraging blockchain. It brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 73-page report also highlights key industry trends in the blockchain space and Avasant’s viewpoint on them.

December, 2021

-

Cerner Acquisition to Launch Oracle Higher into Healthcare

Earlier this month, Oracle and Cerner jointly announced an agreement for Oracle to acquire Cerner, a provider of digital systems to healthcare providers. The deal of approximately $28 billion will be the largest in Oracle’s history, nearly three times the size of its PeopleSoft acquisition in 2005. To understand the rationale behind the deal and what it means for the two companies, the industry, and especially for Cerner customers, we interviewed Avasant partners, consultants, and fellows who focus on the healthcare industry. This research byte summarizes our point of view.

December, 2021

-

Workday HCM Services 2021–2022 RadarView™

The Workday HCM Services 2021–2022 RadarView™ helps enterprises define their approach for Workday HCM adoption and identify the right implementation partner to support them in their journey. It assesses Workday service providers based on their ability to offer implementation and managed services with limited disruption. The 58-page report also provides our point of view on how Workday service providers are catering to the changing needs of enterprises through a wide portfolio of accelerators and preconfigured solutions, thus delivering a general ranking based on key dimensions of practice maturity, partner ecosystem, and investment and innovation.

December, 2021

-

Hybrid Enterprise Cloud Services 2021–2022 RadarView™

The Hybrid Enterprise Services 2021–2022 RadarView™ provides information to assist enterprises in charting out their action plan for developing a hybrid cloud environment. It identifies key global service providers and system integrators that can help expedite their digital transformation journeys. It also brings out detailed capability and experience analyses of leading providers to assist organizations in identifying strategic partners. The 87-page report also highlights top industry trends in the hybrid cloud space and Avasant’s viewpoint on them. It delivers a general ranking across the key dimensions of practice maturity, partner ecosystem, and investment and innovation.

December, 2021

-

Oracle Cloud ERP Services 2021–2022 RadarView™

The Oracle Cloud ERP Services 2021–2022 RadarView™ helps enterprises define their approach for Oracle Cloud ERP adoption and identify the right implementation partner to support them in their journey. It assesses implementation services providers based on their ability to offer services with limited disruption. The 75-page report also provides our point of view on how Oracle Cloud ERP implementation service providers are catering to the changing needs of enterprises through a multitude of customized frameworks, proprietary tools, and platforms, thus delivering a general ranking based on key dimensions of practice maturity, partner ecosystem, and investment and innovation.

December, 2021

-

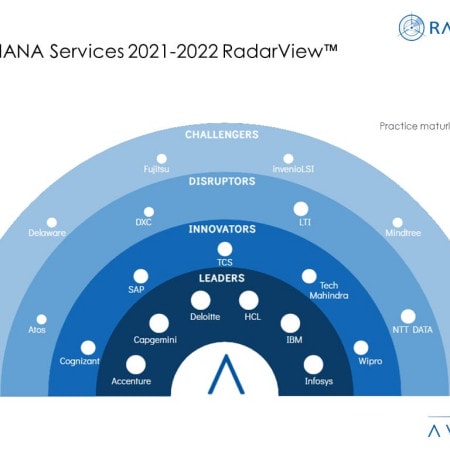

SAP S/4HANA Services 2021–2022 RadarView™

The SAP S/4HANA Services 2021–2022 RadarView™ helps enterprises define their approach for SAP S/4HANA adoption and identify the right implementation partner to support them in their journey. It assesses implementation services providers based on their ability to offer services with limited disruption. The 71-page report also provides our point of view on how SAP S/4HANA implementation service providers are catering to the changing needs of enterprises through a wide portfolio of accelerators and preconfigured solutions, thus delivering a general ranking based on key dimensions of practice maturity, partnership ecosystem, and investment and innovation.

November, 2021

Grid View

Grid View List View

List View