-

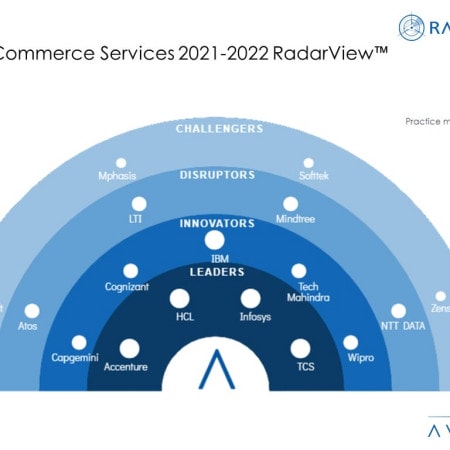

Digital Commerce: Paving the Way for the Next Phase of Growth

Rapidly changing consumer behavior and supply chain disruptions have forced companies to pivot to new business and delivery models and to deploy new modes of customer engagement. Direct-to-consumer (D2C) commerce, omnichannel commerce, and adoption of digital channels for sales and payments have grown rapidly during and after pandemic shutdowns. This led to a growing demand for digital commerce services across industry verticals with service providers expanding their revenues by nearly 30% between 2020 and 2021. These emerging trends are covered in Avasant’s Digital Commerce Services 2021–2022 RadarView™.

-

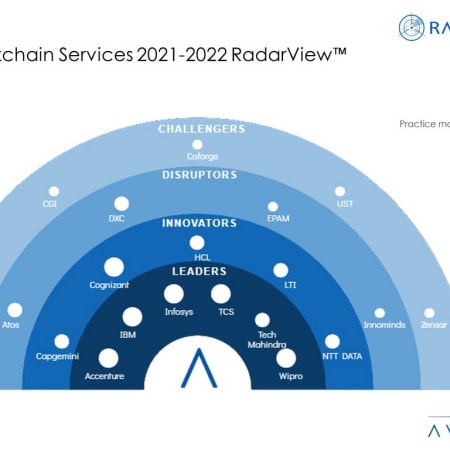

Blockchain Services 2021–2022 RadarView™

The Blockchain Services 2021– 2022 RadarView™ provides information to assist enterprises in identifying key application areas and use cases and developing a strategy around blockchain adoption. It helps organizations in charting out an action plan to drive blockchain initiatives. The report identifies key blockchain service providers who can help companies expedite business transformation leveraging blockchain. It brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 73-page report also highlights key industry trends in the blockchain space and Avasant’s viewpoint on them.

December, 2021

-

Blockchain: Building Trust in the New Normal

During the pandemic, organizations slowed their blockchain investments as they gave top priority to business continuity, remote and hybrid work, cybersecurity, and digital transformation. Now, however, as we emerge from the pandemic, organizations are showing renewed interest in blockchain, especially around new use cases in the medical supply chain, healthcare surveillance, and procurement optimization. These emerging trends, and others, are covered in Avasant’s Blockchain Services 2021–2022 RadarView™.

December, 2021

-

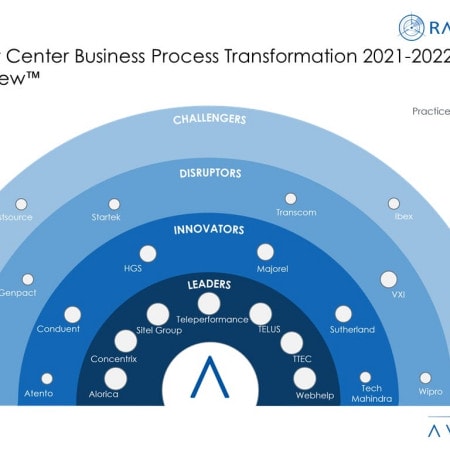

Contact Center Business Process Transformation 2021– 2022 RadarView™

The Contact Center Business Process Transformation 2021 –2022 RadarView™ provides information to assist enterprises in building a contact center service strategy and charting out an action plan for customer service transformation. It identifies key global contact center service providers that can help expedite transformation of the customer service function. It also brings out detailed capability and experience analyses of leading providers to assist enterprises in identifying the right strategic partners. The 85-page report highlights key industry trends in the contact center space and Avasant’s viewpoint on them.

December, 2021

-

Cerner Acquisition to Launch Oracle Higher into Healthcare

Earlier this month, Oracle and Cerner jointly announced an agreement for Oracle to acquire Cerner, a provider of digital systems to healthcare providers. The deal of approximately $28 billion will be the largest in Oracle’s history, nearly three times the size of its PeopleSoft acquisition in 2005. To understand the rationale behind the deal and what it means for the two companies, the industry, and especially for Cerner customers, we interviewed Avasant partners, consultants, and fellows who focus on the healthcare industry. This research byte summarizes our point of view.

December, 2021

-

Embracing Digital First to Transform Customer Service

The global contact center outsourcing services industry grew 15% between 2020 and 2021. Lockdowns and social distancing made it difficult for enterprises to keep their contact centers operating at capacity, and outsourcing closed the gap. The pandemic has changed customer expectations, and customer service is becoming omnichannel and cloud-based. Contact centers are adopting hybrid work and using a contact-center-as-a-service (CCaaS) model to maintain business continuity and prepare for future disruption. These emerging trends are covered in Avasant’s Contact Center Business Process Transformation 2021– 2022 RadarView™.

December, 2021

-

Workday HCM Services 2021–2022 RadarView™

The Workday HCM Services 2021–2022 RadarView™ helps enterprises define their approach for Workday HCM adoption and identify the right implementation partner to support them in their journey. It assesses Workday service providers based on their ability to offer implementation and managed services with limited disruption. The 58-page report also provides our point of view on how Workday service providers are catering to the changing needs of enterprises through a wide portfolio of accelerators and preconfigured solutions, thus delivering a general ranking based on key dimensions of practice maturity, partner ecosystem, and investment and innovation.

December, 2021

-

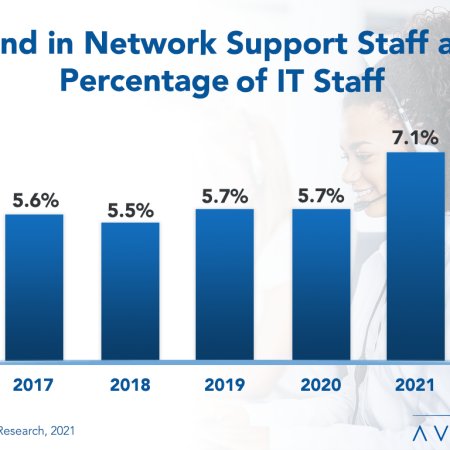

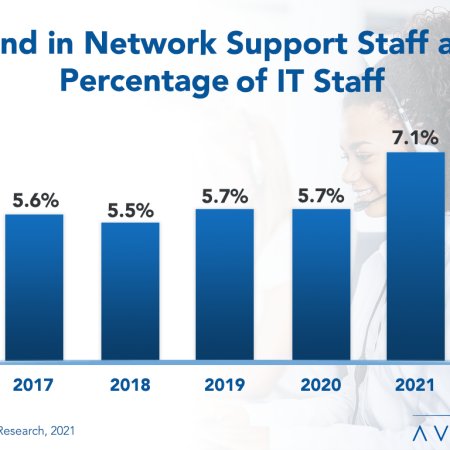

Network Support Staffing Ratios 2021

Computer networks are more important than ever. Although the level of network support staffing has plateaued in previous years, there are signs of resurgence. This report will help IT managers determine whether their organization is keeping pace with improvements in network management by comparing their network support staffing ratios against industry benchmarks. We provide four benchmarks: network support staff as a percentage of the IT staff, network support staff as a percentage of the Network and Communications Group, network devices per network support staff member, and users per network support staff member. We provide benchmarks by organization size and sector. We conclude with recommendations for optimizing the cost of network support staff.

December, 2021

-

Hybrid Work Stimulating Demand for Network Support Personnel

Although the level of network support staffing plateaued in previous years, there are now signs of resurgence. This is largely the result of the COVID-19 pandemic, with remote and hybrid work styles increasing the demand for network support personnel. This Research Byte summarizes the five-year trend in network support staffing ratios.

December, 2021

-

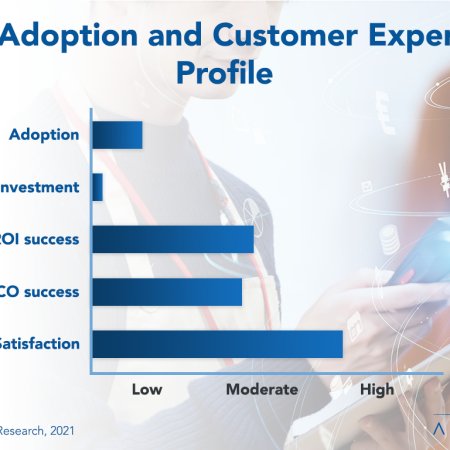

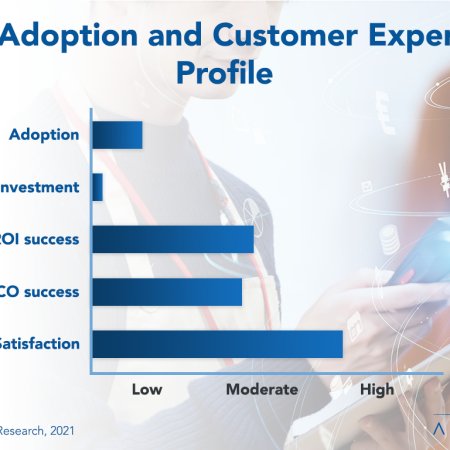

RFID Adoption Trends and Customer Experience 2021

Radio-frequency identification is gaining ground in certain industry sectors and applications where its benefits are clear. Although RFID may one day become even more widespread than barcodes, it will take longer than its advocates hope for. This report quantifies the current adoption and investment trends for RFID technology as well as the benefits driving companies to expand their RFID implementations. We assess these trends by organization size and sector and examine the ROI and TCO experiences of adopters. We conclude with practical advice for planning new investments in RFID technologies.

December, 2021

-

Workday Increasingly Relying on Partners to Provide HCM Implementation and Managed Services

Over the past decade, Workday has shown strong growth in its cloud-based suite for human capital management (HCM), especially among large enterprises. Now to continue its pace of growth, Workday expands its focus to include midsized organizations and also customers outside North America. To execute this strategy, it is increasingly relying on implementation and managed services providers to reach these prospective buyers. This RadarView provides an analysis of the service providers that are working in partnership with Workday to carry out this strategy.

December, 2021

-

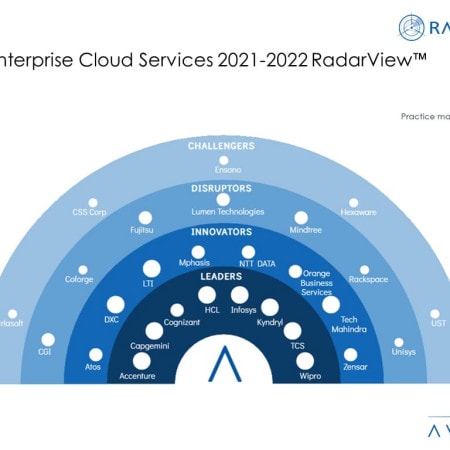

Hybrid Cloud: From Optimization to Automation

As organizations increasingly move workloads to the cloud, there has been a gradual shift from merely lifting and shifting systems to cloud to a truly cloud-native architecture for modernization and automation. IT leaders are looking to incorporate intelligent cloud management practices such as artificial intelligence for IT operations (AIOps), DevOps, and financial operations (FinOps) to reduce deployment efforts and optimize cloud spend. To address this shift, traditional service providers are building their own tools and accelerators and acquiring next generation cloud service providers.

December, 2021

-

Hybrid Enterprise Cloud Services 2021–2022 RadarView™

The Hybrid Enterprise Services 2021–2022 RadarView™ provides information to assist enterprises in charting out their action plan for developing a hybrid cloud environment. It identifies key global service providers and system integrators that can help expedite their digital transformation journeys. It also brings out detailed capability and experience analyses of leading providers to assist organizations in identifying strategic partners. The 87-page report also highlights top industry trends in the hybrid cloud space and Avasant’s viewpoint on them. It delivers a general ranking across the key dimensions of practice maturity, partner ecosystem, and investment and innovation.

December, 2021

-

Canada Digital Services 2021–2022 RadarView™

The Canada Digital Services 2021–2022 RadarView™ addresses Canadian enterprises’ needs and helps them identify and adopt the right technologies combined with appropriate implementation strategies. The 91-page report also identifies key service providers and system integrators that can help these enterprises in business transformation.

December, 2021

-

RFID Slowly Gaining Ground but Tagged with Cost Concerns

Radio-frequency identification (RFID) is gaining ground in certain industry sectors and applications where its benefits are clear. But adoption of the technology has been relatively slow, due to its expensive upfront costs, high number of tags and frequencies, and the difficulty integrating the technology into systems. This Research Byte summarizes the full report, RFID Adoption Trends and Customer Experience.

December, 2021

Grid View

Grid View List View

List View